Options Market Statistics: Nvidia's Stock Extends Gains as CEO Cites Magnitude of Chip Demand

News Highlights

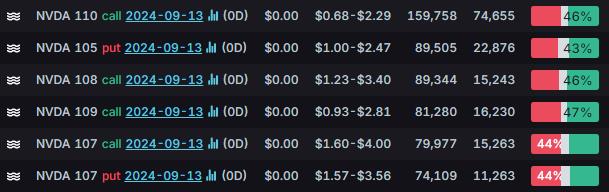

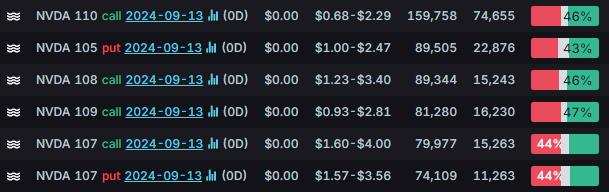

$NVIDIA (NVDA.US)$ shares rose 1.92% Thursday to close at $119.14, with option volume of 5.72 million, and calls accounted for 62.6% of the volume. The $110 calls expiring September 13 lead the flow with the highest volume.

Semiconductor stocks, led by Nvidia and $Broadcom (AVGO.US)$, rebounded this week due to strong AI chip sales, and improvements in the smartphone, PC, industrial, and automotive markets. Bernstein analyst Stacy Rasgon highlighted Nvidia and Broadcom as top picks in the sector, both rated as outperform. Broadcom's stock rose 4% to 164.56, and Nvidia's stock gained 1.9% to 119.14. Nvidia CEO Jensen Huang emphasized the high demand for AI chips, particularly the Blackwell chip, which will begin shipping in Q4.

$Tesla (TSLA.US)$ shares rose 0.74% Thursday to close at $229.81, with option volume of 1.77 million, and calls accounted for 60.3% of the volume. The $225 calls expiring September 13 lead the flow with the highest volume.

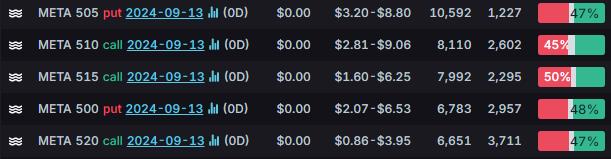

$Meta Platforms (META.US)$ shares climbed 2.69% Thursday to close at $525.60, with option volume of 0.37 million, and calls accounted for 63.5% of the volume. The $505 puts expiring September 13 lead the flow with the highest volume.

Unusual Stock Options Activity

There was a noteworthy activity in $Walmart (WMT.US)$, where $81 calls have topped volume to open interest ranking. The highest volume over open interest ratio reaches 222.2x with 23,329 contracts.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Clement Lemons : okk

74423696 : WOW

Clement Lemons : okk