Options Market Statistics: Salesforce Earnings Top Estimates Amid Software Maker's 2023 Rally, Shares Surge And Options Pop

News Highlight

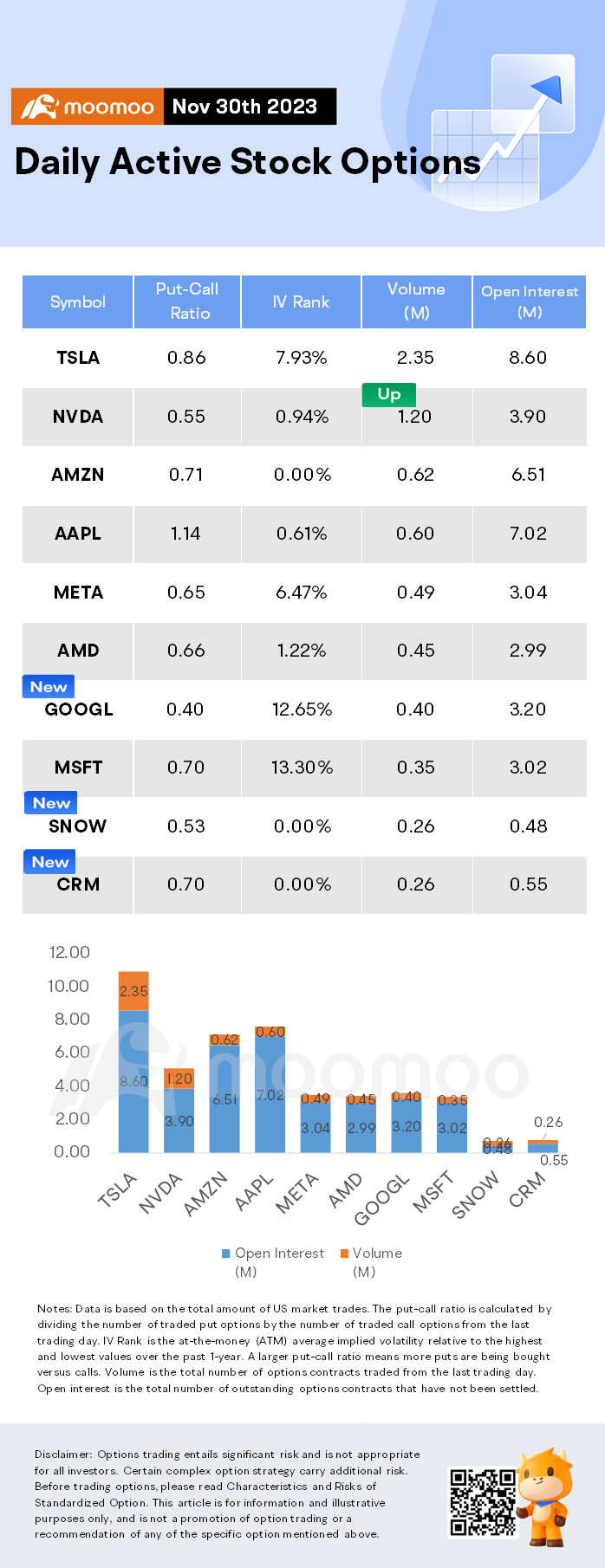

$NVIDIA (NVDA.US)$ shares fell by 2.85%, closing at $467.70. Its options trading volume is 1.20 million. Call contracts account for 64.5% of the whole trading volume.

$Snowflake (SNOW.US)$ shares rose by 7.05%, closing at $187.68. Its options trading volume is 0.26 million. Call contracts account for 65.5% of the whole trading volume.

Shares in Snowflake popped after the software maker reported third quarter earnings and revenue that topped estimates amid stabilizing growth at cloud computing partner $Amazon (AMZN.US)$. Guidance for SNOW stock came in above expectations.

The company released its Snowflake earnings report after the market close on Wednesday. Revenue climbed 32% to $734.2 million, the enterprise software maker said. Analysts projected Q3 revenue of $713.8 million.

On an adjusted basis, Snowflake earnings were 25 cents, up 127%. Analysts expected Snowflake to report adjusted profit of 16 cents per share.

Echoing commentary from other (software and cloud) vendors, Snowflake noted continued stabilization in consumption from customers, with September growth exceeding expectations," said William Blair analyst Jason Ader in a report. "This improvement in consumption is being driven by expansions within Snowflake's largest customers (9 of the top 10 customers grew sequentially) as they lap optimization initiatives and refocus on migrating away from legacy data warehouses."

$Salesforce (CRM.US)$ shares rose by 9.36%, closing at $251.90. Its options trading volume is 0.26 million. Call contracts account for 58.9% of the whole trading volume.

Salesforce reported adjusted earnings per share (EPS) of $2.11, five cents better than the average Wall Street forecast, which amounted to a more than 50% increase from the same quarter a year ago. Revenue printed in-line at $8.72 billion, up 11% YoY.

Salesforce's AI-geared product Data Cloud is being run by more than 1,000 customers in a trial period. Another AI-infused platform, Einstein GPT CoPilot, is now being utilized by 17% of the Fortune 500 and conducts 1 trillion queries per week. Analysts were excited by the speed of AI adoption and view the figures as a catalyst for large-scale growth ahead.

We are the number one AI [Customer Relationship Management]," said CEO Marc Benioff on the earnings call. "If that isn't clear already, we're leading the industry through the unprecedented AI innovation cycle."

Unusual Stock Options Activity

Some notable call activity is being seen in $Alphabet-A (GOOGL.US)$, which is primarily being driven by activity on the Dec 1st 133 call. Volume on this contract is 60,332 versus open interest of 728.

Daily Active Index & Sector ETF Options

Source: Benzinga, Dow Jones, CNBC, Reuters

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment