Options Market Statistics: Tesla Stock Jumps on Accelerated Production Plans Despite Earnings Miss

News Highlights

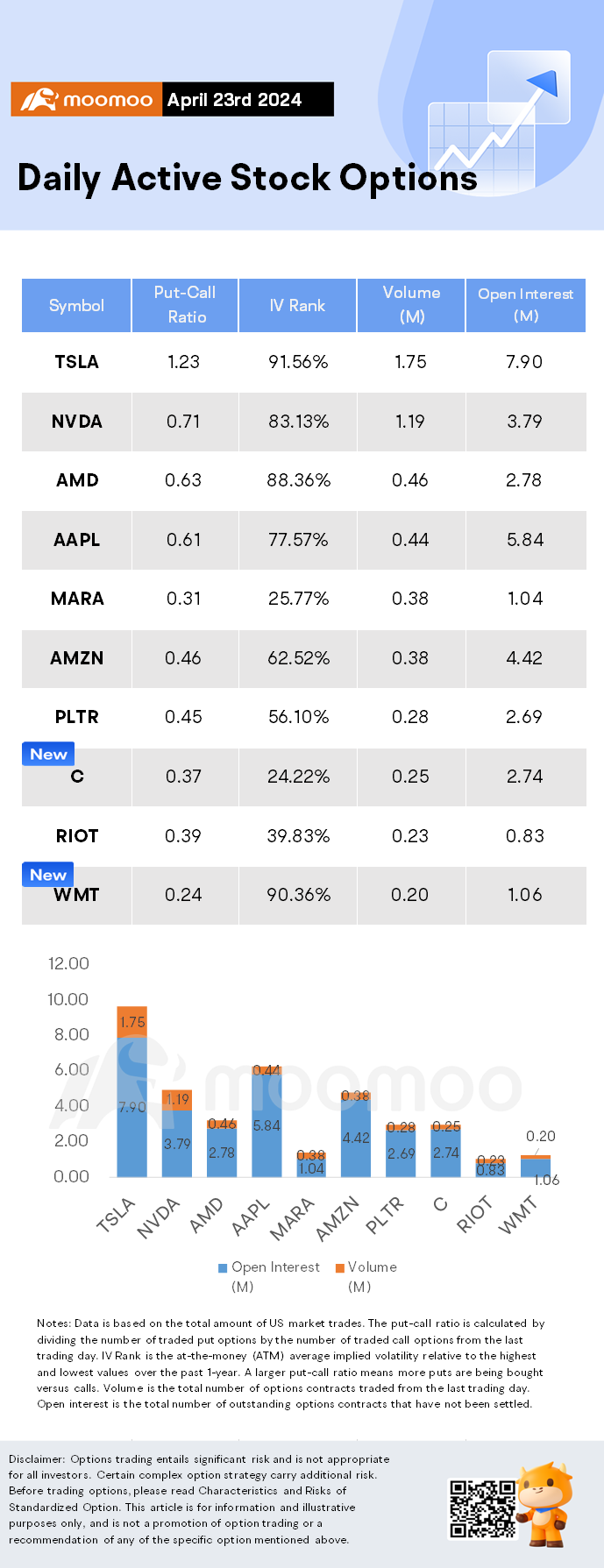

$Tesla (TSLA.US)$ shares rose by 1.85%, closing at $144.68. Its options trading volume was 1.75 million. Call contracts account for 44.8% of the total trading volume. The most traded calls are contracts of $160 strike price that expire on Apr. 26th. The total volume reaches 48,736 with an open interest of 28,774. The most traded puts are contracts of a $140 strike price that expires on Apr. 26th; the volume is 53,232 contracts with an open interest of 25,881.

Tesla shares jumped in after-hours trading Tuesday despite an earnings miss, as the electric vehicle maker said it would accelerate production of new models, including a lower-cost vehicle.

Tesla's revenue for the first quarter came in at $21.3 billion, representing a 9% year-over-year decline, while adjusted net income was $1.54 billion, down 48% from the year-ago period.

$NVIDIA (NVDA.US)$ shares rose by 3.65%, closing at $824.23. Its options trading volume was 1.19 million. Call contracts account for 58.6% of the total trading volume. The most traded calls are contracts of $850 strike price that expire on Apr. 26th. The total volume reaches 44,689 with an open interest of 10,553. The most traded puts are contracts of a $800 strike price that expires on Apr. 26th; the volume is 35,131 contracts with an open interest of 6,543.

$Citigroup (C.US)$ shares rose by 2.82%, closing at $62.67. Its options trading volume was 0.25 million. Call contracts account for 73% of the total trading volume. The most traded calls are contracts of $64 strike price that expire on Apr. 26th. The total volume reaches 24,060 with an open interest of 2,193. The most traded puts are contracts of a $53 strike price that expires on May 10th; the volume is 5,730 contracts with an open interest of 39.

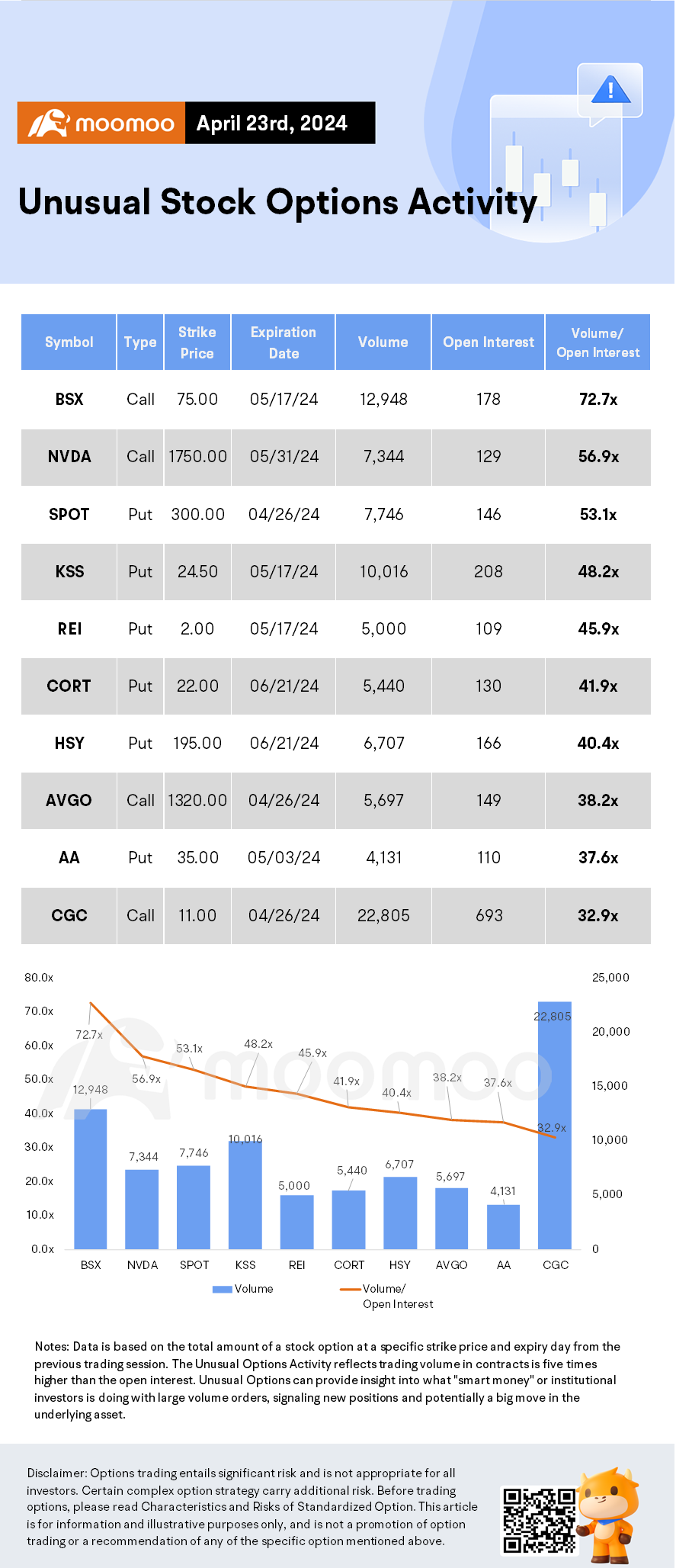

Unusual Stock Options Activity

Some notable call activity is being seen in $Boston Scientific (BSX.US)$, which is primarily being driven by activity on the May 17 Call. Volume on this contract is 12,948 versus open interest of 178.

For all the mooers in Singapore, you can now lower your options commssions with our new campaign. Come check the link: US Stock Option.

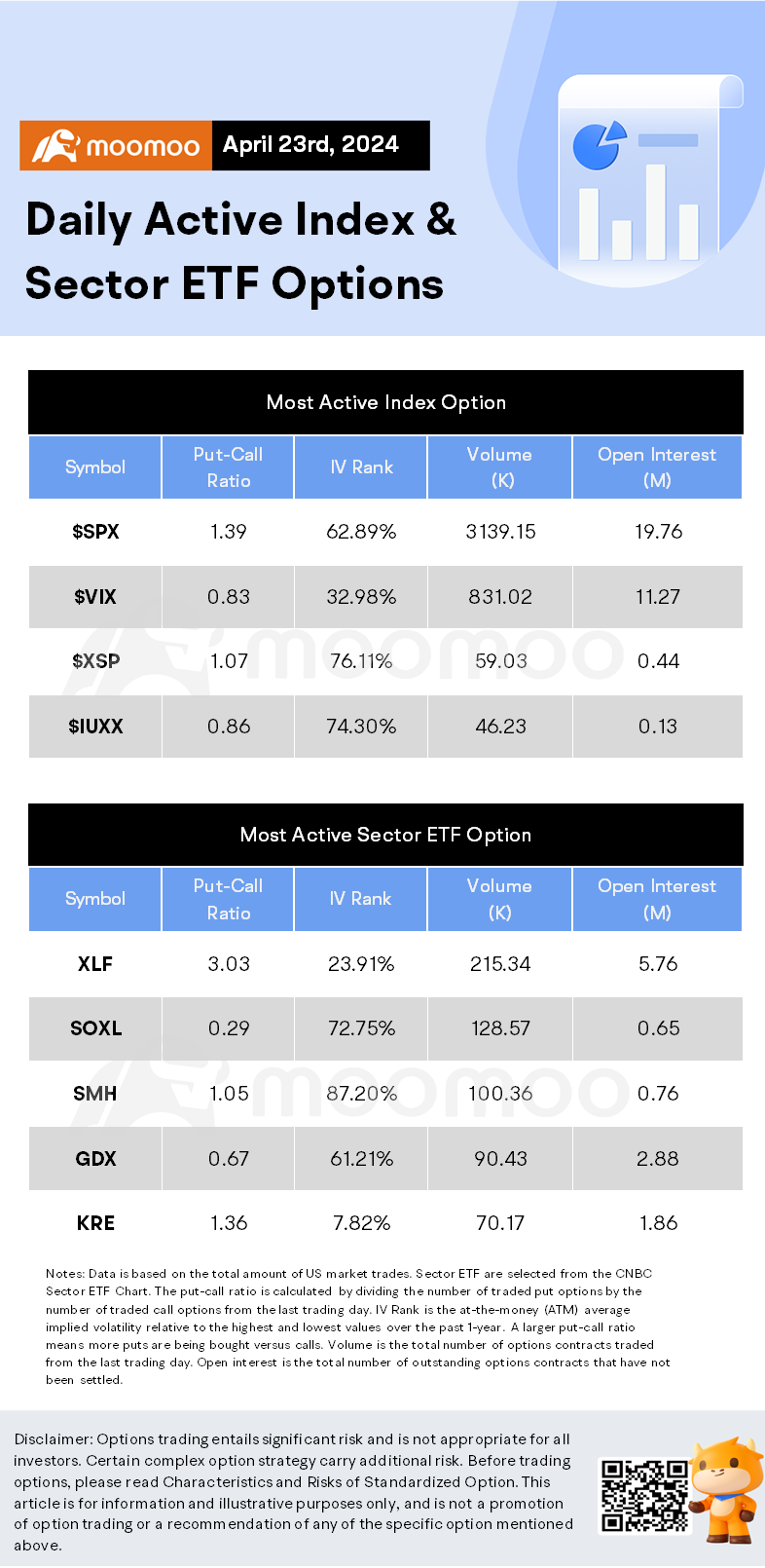

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, WSJ, Reuters

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

104575863 : Hai

103625245 : hai guys

74049856 : someone please close my account