Rate Cut Bets Are Heating Up Again: Where Should Investors Focus?

On the "most exciting Wednesday" with both CPI and FOMC meeting, the May inflation data, which cooled down more than expected, once again ignited hopes for interest rate cuts. After the data release, traders increased the probability of a rate cut in September, and expected two more 25 basis points rate cuts this year. This optimistic sentiment even overshadowed the subsequent release of the "hawkish" dot plot, as well as the cautious statement by Powell, and the US stock market began to celebrate. The $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ both hit record highs for three consecutive days, and large technology companies collectively took off. The four largest technology giants, $Microsoft (MSFT.US)$, $Apple (AAPL.US)$, $NVIDIA (NVDA.US)$, and $Alphabet-A (GOOGL.US)$, all closed at historic highs.

Looking back at the performance of the US stock market during the period of transitioning from rate hikes to rate cuts in previous years, three out of four rounds witnessed a rise in the stock market.

With the countdown to the US Fed's interest rate cut in 2024 underway, what investment opportunities are worth paying attention to?

1. Technology stocks lead the way

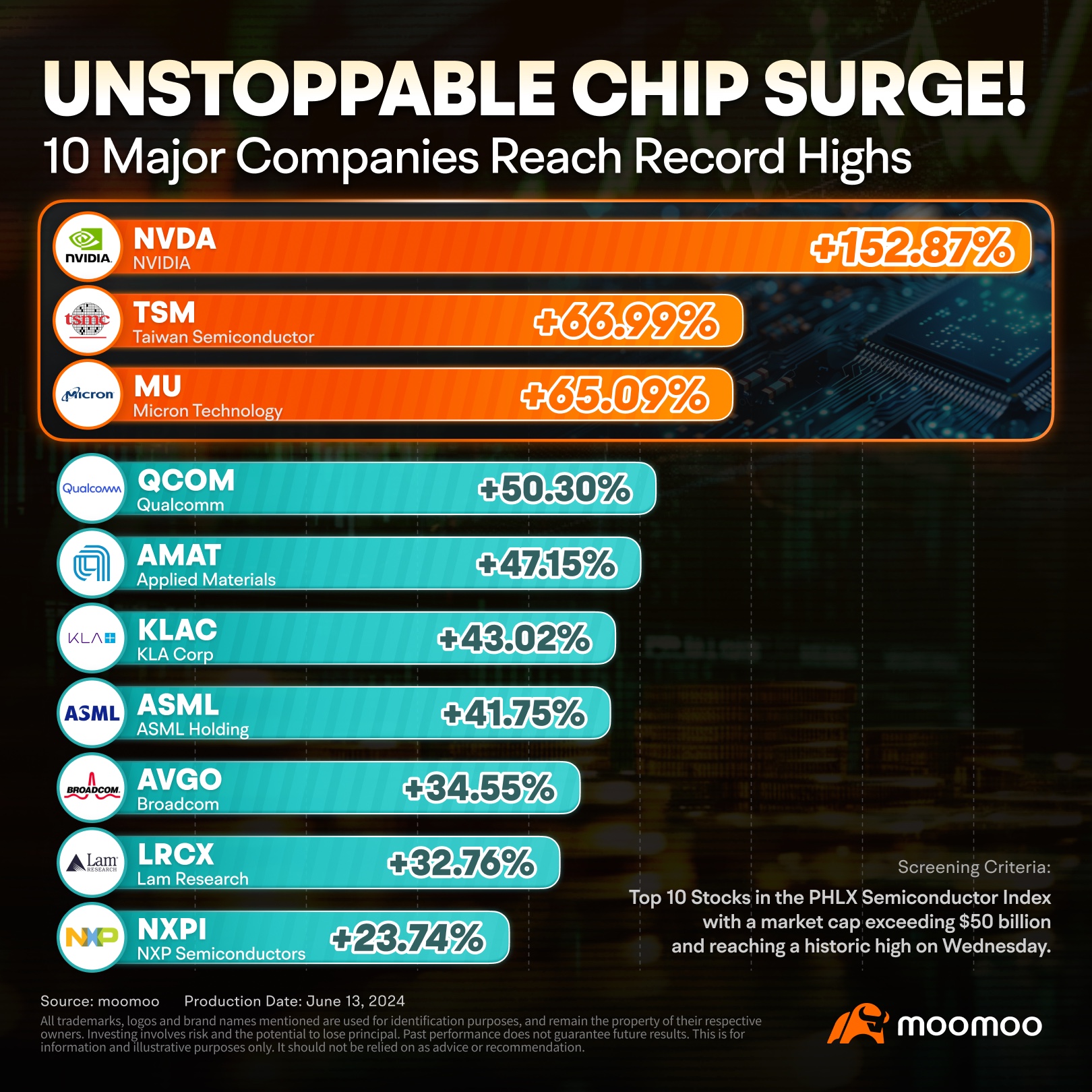

On Wednesday, as market risk appetite and sentiment rose, seven out of the 11 industry sectors covered by the S&P 500 index saw gains, with Information Technology leading the pack with a 2.46% increase. Tech stocks, particularly chip stocks, received the most attention with several stocks, including $Taiwan Semiconductor (TSM.US)$, $ASML Holding (ASML.US)$, $Broadcom (AVGO.US)$, in addition to Nvidia, setting new price records on Wednesday.

Interest rate cuts usually provide a significant boost to tech stocks. For tech companies that require large amounts of capital for research and expansion, lower interest rates will significantly reduce their financing costs and free up profit margins.

From a valuation perspective, higher growth means that tech stocks have more future cash flows to be realized, and lower interest rates enhance the value of these future cash flows when discounted. Looking back at the history of interest rate cuts since the 1990s, tech stocks have outperformed other sectors on average after rate cuts were implemented.

2. Small-Cap Stocks Make a Comeback

The recent increase in market risk appetite has brought small-cap stocks back to the forefront after a long period of dormancy. On Wednesday, the $Russell 2000 Index (.RUT.US)$ and S&P 600 indexes, composed of top small-cap companies in the US, rose by 1.62% and 1.65%, respectively, outperforming the $S&P 500 Index (.SPX.US)$'s 0.85%.

Some analysts are optimistic that small-cap stocks, which are more sensitive to interest rates and economic conditions, may receive the greatest boost from the Fed's rate cut.

From a fundamental perspective, small-cap stocks that rely more heavily on short-term debt financing are more vulnerable to damage in a high-interest-rate environment and have weaker profitability. Rate cuts will significantly reduce their financial burden and other costs, thereby improving their earnings expectations. These types of companies have more prominent earnings elasticity and may even achieve a turnaround from loss to profit or rapid growth during a policy shift towards marginal easing.

In addition, the positive signal of a rate cut will greatly boost market sentiment and risk appetite, directing funds towards small-cap stocks with higher growth potential but higher risk. John Mowrey, Chief Investment Officer of NFJ Investment Group, believes that even a moderate transfer of funds from the 20 largest US companies to other stocks could have a huge impact on low market capitalization stocks.

From a valuation repair perspective, after a difficult start, small-cap stock valuations are now at a relatively low level, with a higher margin of safety. small-cap stocks valued by price-to-book ratio are at their cheapest level since the end of 2000 compared to the S&P 500. In terms of PE ratio, according to Tom Lee's research at Fundstrat, the price-to-earnings ratio of reliable small-cap companies in the Russell 2000 index is 11 times, significantly lower than the S&P 500 index's 21 times P/E ratio. Tom Lee reiterated his call for the small-cap $Russell 2000 Index (.RUT.US)$ to climb 50% in 2024 and top 3,000 for the first time.

As rate cuts approach, small-cap stocks are expected to narrow the valuation gap with large-cap stocks for the remaining year. Below are the top winers in Russell 2000, with RNA having already gained more than 300% YTD return:

3. Interest-Sensitive Stocks Show Strong Performance

From the perspective of industry allocation, sectors that are more sensitive to interest rates, such as real estate, biotechnology, and regional banks, are expected to benefit first from rate cuts. The gains in these sectors were also significant on Wednesday.

● Homebuilders: The S&P Homebuilders Select Industry Index rose by 3.50% on Wednesday. A decrease in policy rates will lead to a decrease in mortgage rates, thereby reducing the financial costs for home buyers, increasing purchasing willingness and boosting the demand for real estate. Based on this, as the reduction in home prices or other promotional methods decreases, profit margins for real estate companies may also improve.

● Biotechnology:The S&P Biotechnology Select Industry Index rose by 1.47% on Wednesday. Biotech stocks are highly sensitive to interest rates. As interest rates decline, the financing costs of the capital-intensive biotech industry are expected to decrease significantly, thereby alleviating issues with layoffs, R&D, and production line reductions. In addition, as the biotech industry has strong growth potential, the decrease in interest rates will increase the value of future cash flows.

● Regional banks:The S&P Regional Banks Select Industry Index rose by 2.53% on Wednesday. These banks are expected to benefit from the rate cut as it eases their business pressures.

4. U.S. Treasury Investment Opportunities on the Rise

Encouraged by the CPI report, bond traders increased their bets on rate cuts this Wednesday, and even Powell's hawkish comments failed to shake that belief. As a result, US bond yields fell across the board, with the 2-year yield dropping 8.9 basis points to 4.756%, and the 10-year yield also declining by about 9.4 basis points. The rate cut is expected to drive down US Treasury yields, thus boosting bond prices.

According to Akira Takei, a fixed-income manager at Asset Management One Co, who has overweight positions in five- to 10-year Treasuries:

"I got the impression that the Fed will pivot quickly once the job market shows rapid deterioration; I don't think the market has factored in that risk."

Source: Bloomberg, Marketwatch

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

10baggerbamm : a key point that no one is discussing that should be brought out front and center is... if you believe what chairman Powell has said yesterday and in the past then you must factor in what he said several months ago. and that was the FED is prepared to take action data dependent in between a Fed meeting the Fed can and may lower interest rates in between meetings so they don't have to wait till July they don't have to wait till September they don't have to wait till December they can do it in between a meeting and imagine the shock in the market if chairman Powell is going to speak momentarily what's he going to say and he says we've decided quarter point cut it would be a ballistic missile launch in the following sectors. real estate regional Banks utilities. of course tech stocks will continue rallying but on the margin the ones with the greatest gains are the regional Banks (DPST) are specific real estate investment trust (DRN) and utilities (UTSL) THESE ARE LEVERAGED ETFS THEY ARE HIGHLY VOLATILE WHEN SECTORS ARE GOING UP YOU'RE RINGING THE CASH REGISTER WHEN THE UNDERLYING STOCKS FALL YOU ARE GETTING HAMMERED AND WILL EXPERIENCE PAIN LIKE YOU'VE NEVER FELT BEFORE SO BEFORE YOU RUN OUT AND BUY THEM DO YOUR HOMEWORK ASK QUESTIONS AND LEARN. These are some of leveraged ETFs that I buy that I trade that I position myself in in anticipation of movements within sectors.

Morteza safarii : 2024

搞经济 抄底 加仓 : Naa.. FED will just make up another story

muhamad Hazairudin s : Muhamad Hazairudin Shadan

muhamad Hazairudin s 10baggerbamm : Muhamad Hazairudin Shadan