Sirius XM Attracts Bullish Option Block Trades After Stock Ranked Most Shorted

$Sirius XM(SIRI.US$ saw financial giants take bullish positions in options two days after the music streaming company ranked as the most-shorted stock.

The stock skyrocketed 13% to$3.515 at 12:35 p.m., building on its rebound from the lowest in more than a decade. That could squeeze speculators betting against the company that saw its total short volume climb 31% to 23.73 million on Monday from the previous trading day, according to exchange data compiled by moomoo show.

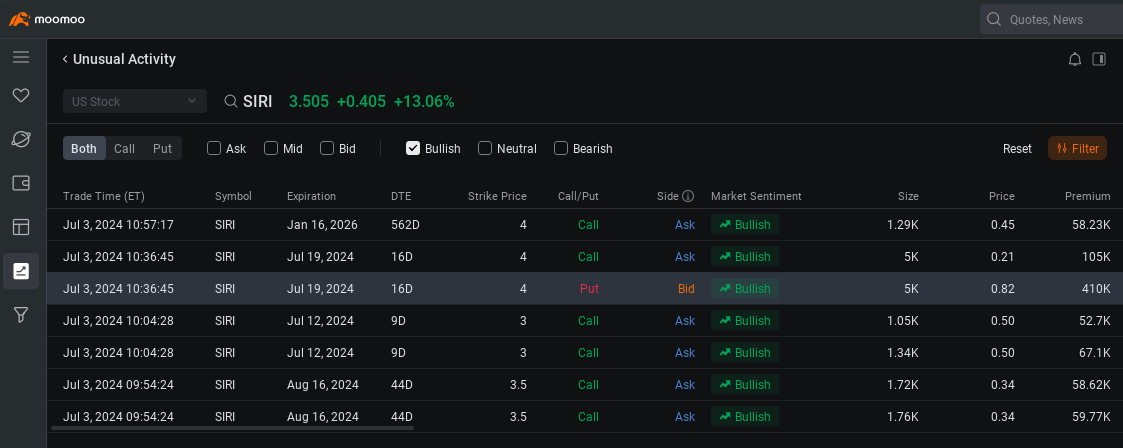

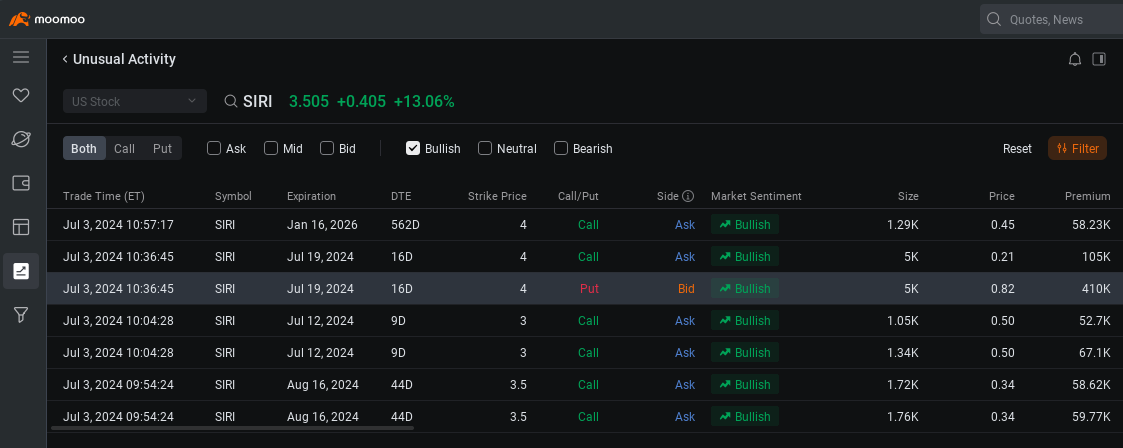

The seven bullish block trades recorded Wednesday morning have a combined premium of more than $800,000. More than half of that total was for a block trade posted at 10:36:45 a.m. in New York Wednesday involving put options that give the holder the right to sell 500,000 shares at $4 each by July 19. The seller stands to collect a premium of $410,000 for writing those 5,000 puts.

The contract, which was sold at 82 cents, closed at 75 cents, making the transaction profitable for the seller, had that financial giant decided to buy it back then.

In a holiday-shortened trading day, almost 260,000 Sirius XM options changed hands Wednesday, making them the ninth most-active stock options, behind $NVIDIA(NVDA.US$, $Tesla(TSLA.US$, $Apple(AAPL.US$, $Amazon(AMZN.US$, $Advanced Micro Devices(AMD.US$, $Nike(NKE.US$, and $Rivian Automotive(RIVN.US$.

The heaviest volume across 13 expiration dates for Sirius contracts stretching all the way through Jan. 16, 2026, was in call options with a $3.50 strike price, just slightly below the stock's closing price of $3.53.

The optimism for the stock is also seen in capital trend data tracked by moomoo. Inflows to Sirius XM outpaced outflows by $16.23 million, adding to the stock's second monthly net inflows.

That positive trend, however, contradicts the early warning signals gleaned from technical indicators. Eleven of the 15 technical gauges are flashing signs that the stock could be overbought and may be turning bearish. The remaining four are neutral.

Share your thoughts on Sirius XM below. Where do you think are shares headed?

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See thislinkfor more information.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors readCharacteristics and Risks of Standardized Optionsbefore engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors readCharacteristics and Risks of Standardized Optionsbefore engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

SK7867 : Go

103492747 : GOOD MORNING

章允量 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

shamsury79 : Good morning everyone

罗拔图 : yes

103648138 : female

105535782 : hi

103618153 : Hi

Paul Anthony : for young children

104534743 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)