The Nonfarm Payroll Benchmark Is Set to Undergo an Annual Revision. What Are the Impacts?

On Wednesday, the nonfarm payroll benchmark will undergo its annual revision, and the market expects a significant downward revision of 500,000 to 1 million jobs, which raises questions about the strength of the jobs market just ahead of Jackson Hole central bank's meeting this week.

1. Why does the nonfarm payroll benchmark need revision?

The usual monthly nonfarm payroll figures are based on sample surveys, while the benchmark revision uses the Quarterly Census of Employment and Wages, a census data that is more thorough, albeit not as up-to-date, to estimate the annual total sample size. The QCEW gathers its data from state unemployment insurance tax records, which cover nearly the entirety of jobs across the United States.

Since the benchmark is set in March, the impact of a downward revision is significantly different before and after March. In the case of a substantial downward revision, the monthly job gains for the year prior to March would need to be systemically reduced, but the data from the most recent April to July would be almost unaffected.

For example, if this year's March nonfarm payroll benchmark is ultimately reduced by 1.2 million, this means that the monthly nonfarm payroll surveys from last April to this March overestimated the total job gains by 1.2 million, which means an average overestimation of 100,000 jobs per month.

2. Is there any pattern to the nonfarm payroll benchmark's revisions, whether upward or downward?

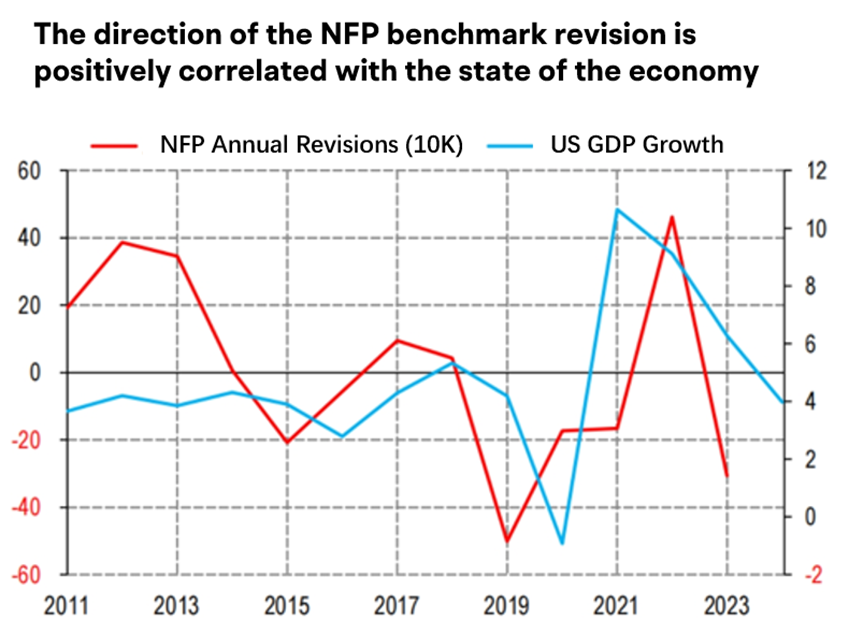

If we look at the data from recent years, the better the economic growth, the more likely it is that sample surveys underestimate the overall situation, leading to an upward revision of the benchmark; conversely, the worse the economy, the more likely a downward revision is needed.

Given that this year's employment is weaker than last year, it is normal for the market to expect a downward revision in the 2024 benchmark. The already published QCEW data also indicates that the monthly nonfarm payroll of 2023 may be significantly overestimated. Throughout the full year of 2023, the final tally of nonfarm payrolls from the monthly surveys showed an increase of approximately 3.01 million jobs; during the same period, based on the data from the QCEW, there was an increase of about 2.32 million in nonfarm employment, resulting in a discrepancy of approximately 700,000 between the two datasets.

3. How to interpret the upcoming revision?

Economists at Wells Fargo anticipate that following the BLS revision, the nonfarm employment growth for the year ending in March will be at least 600,000 lower than the current figures, equivalent to about 50,000 fewer jobs added per month. Analysts at JPMorgan Chase believe that the nonfarm employment for the year to March will be revised down by about 360,000, while Goldman Sachs predicts that between 600,000 and 1 million jobs could be shed in the revision.

Still, even if the BLS announces a significant downward revision of the non-farm employment figures on Wednesday, it does not mean that the growth of employment in the United States has collapsed.

The report from Goldman Sachs suggests that the BLS revision might exaggerate the extent of the labor market's weak growth for the year ending in March because the QCEW largely excludes undocumented immigrants, who have made significant contributions to employment growth. Based on the QCEW, the BLS might mistakenly remove 300,000 to 500,000 nonfarm jobs belonging to undocumented immigrants from the employment figures for the year to March. In other words, the BLS might erroneously revise downward by 300,000 to 500,000 employment positions.

Besides, since the market has largely anticipated this and it's not highly relevant to the recent trends in job gains, the market's reaction should be limited.

However, in practice, sentiment may still be affected. Historical data shows that there is still a correlation between the revision of the nonfarm payroll benchmark and the daily trends in U.S. bonds and stocks. If this week's nonfarm payroll benchmark is revised downward significantly more than expected, it could reignite recession fears and temporarily impact the market's risk appetite.

Source: BLS, Goldman Sachs

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

10baggerbamm : the downward revision is a million jobs in the trailing 12 months not 500,000

CK 淡淡定有錢剩 : Means NO RATE CUT, guys

Seraphicall 10baggerbamm : Damn..

Chewie2000 : Here we go

73029607 : careful bears

10baggerbamm Seraphicall : think of the lies that we are told every week all the economic data that comes out that we're expected to believe is accurate and truthful and we buy and sell stocks based off of this economic data and now you see it's smoking mirrors it's a complete fabrication to push a party in office it's all lies. chairman Powell is so far behind the curve with cutting he's probably shitting a brick because the economy is going to go off a cliff. he should have been cutting back in May and June of this year and this is because there's a 12 to 18 month lag when you raise interest rates before the effect is felt well now you see the real numbers for jobs and how many people are out of work despite the lies that we were told it's far worse than what they reported.

Seraphicall 10baggerbamm : That’s ridiculous

10baggerbamm Seraphicall : what's ridiculous what I am saying you're saying that powells not behind the curve you're saying that there's no delay of 12 to 18 months from a rate cut you're saying that this data is not going to have a serious implication from a partisan standpoint what is ridiculous about what I'm saying?

Seraphicall 10baggerbamm : I am not saying u

103492837 : Thank you for sharing

View more comments...