The U.S. Fiscal Deficit Remains High. Is This Why Gold Prices Keep Breaking Records?

Gold prices hit new milestones last week, reaching a fresh record high of $2,600 on Friday. Expectations of further interest rate cuts bolstered the appeal of bullion, but that is not the only reason.

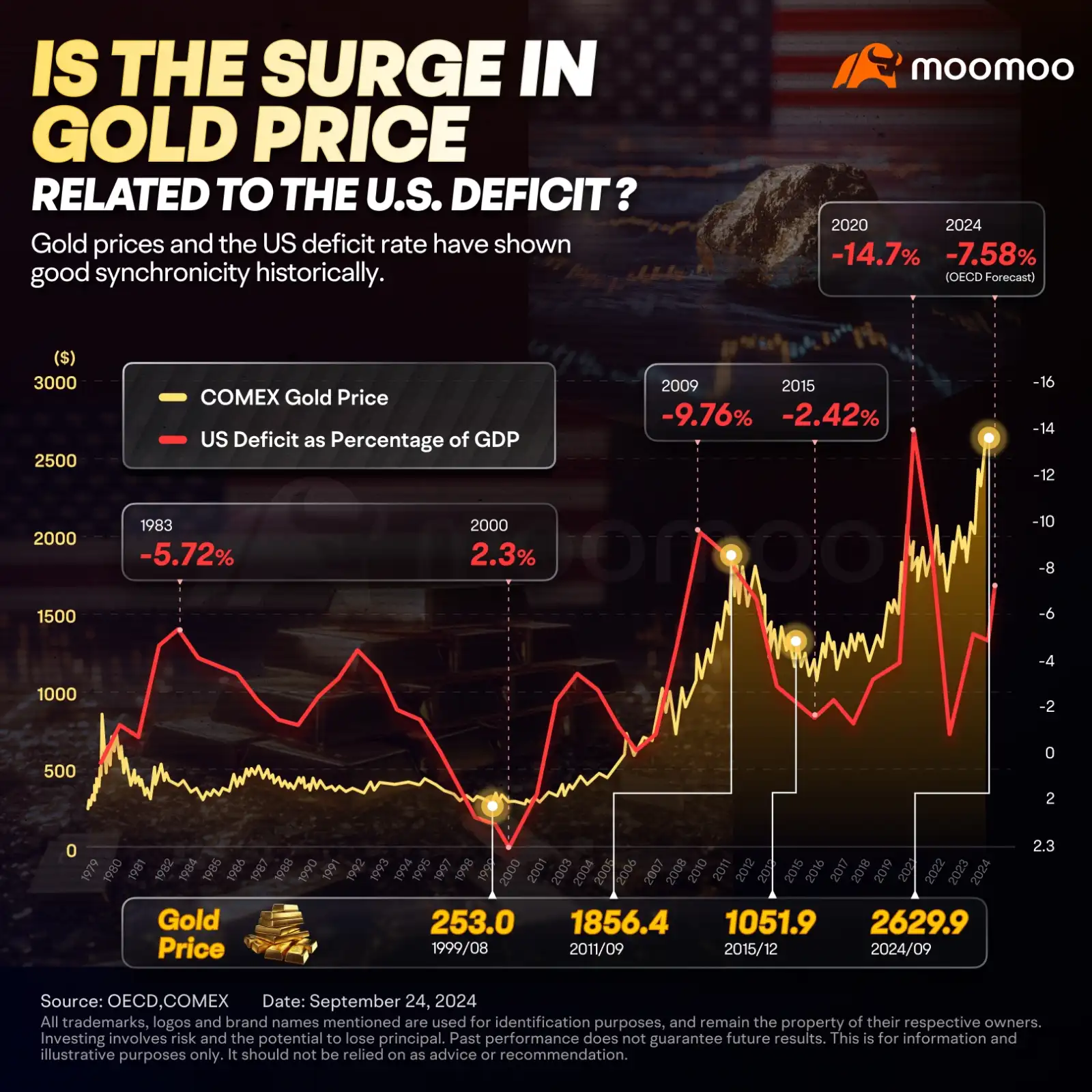

The rising deficit rate in the U.S. is one of the key forces driving gold prices. Historically, Gold prices and the US deficit rate have shown good synchronicity historically:

1. From 1984 to 2000, the US deficit rate decreased, reaching a surplus of 2.3% in 2000; during the same historical period, gold prices, starting from 1981, reached their low point in 2000.

2. From 2001 to 2010, the US deficit rate fluctuated upward, reaching -9.8% in 2009; gold prices rose during the same period, reaching a peak in 2011.

3. Subsequently, the US deficit rate fluctuated downward again, with a low point of -2.4% in 2015, corresponding to a cyclical low in gold prices during the same period.

4. From 2016 to 2019, the deficit rate increased, corresponding to a rebound in gold prices.

5. From 2020 to 2024, the US deficit rate rose significantly; during the same period, the increase in gold prices was even more apparent.

▶ The fiscal deficit faces severe challenges

According to different terms of various presidents in the history, the U.S. is now facing the greatest deficit pressure since World War II, a research report from Bank of America shows.

The huge fiscal deficit is caused by soaring expenditures. U.S. Treasury data indicates that fiscal outlays in Treasury's net interest, national defense, Medicare, and many other fields have continued to grow compared to the same period last year. Rising spending increases the need for government debt issuance, raising the risk of credit devaluation.

▶ Both Harris and Trump's stances point to significant fiscal strength in the future

According to the 10-year budget forecast released by the CBO (Congressional Budget Office) in June, it is expected that non-net interest fiscal budget expenditures will continue to grow over the next decade, with a growth slope higher than before the pandemic. Meanwhile, according to predictions by the IMF, during 2024-2029, the proportion of government debt to GDP will also remain high.

The political stances of both Harris and Trump indicate a strong fiscal stance. Neither Trump nor Harris outlined policies to reduce the deficit in their previous debate. On the one hand, both Harris and Trump support infrastructure investment and the reshoring of manufacturing. On the other hand, in terms of fiscal receipts and expenditure, Trump advocates tax cuts; Harris advocates fiscal policies that reduce living costs, corresponding to an increase in the deficit of 1.7-2 trillion dollars over ten years, a study by CRFB (Committee for a Responsible Federal Budget) shows. Compared to history, this increase of 1.7-2 trillion dollars in deficit is significant. According to CRFB’s estimates, the fiscal deficit to GDP ratio in 2035 is expected to cumulatively increase by 4.65% compared to 2026. Therefore, regardless of who wins the election, it is highly likely that we will not see a significant reduction in fiscal intensity.

Starting September 18, the Federal Reserve entered another easing cycle. The spiral of deficits and Treasury borrowing forces the Federal Reserve to ease again to alleviate the interest payment pressure on the U.S. Treasury, potentially causing an intrinsic devaluation of the dollar.

▶ M2 growth following rate cuts set to bring new capital flows to the gold market

Since April of this year, the US monetary supply gauge, M2, has returned to positive growth. When the growth rate of the money supply exceeds the growth rate of the actual economy, it means that the real purchasing power of money may decline. According to the latest survey by the World Gold Council, 88% of global central banks consider holding gold to be highly relevant or somewhat relevant to a long-term store of value and inflation hedge. The U.S. gold ETF also sees an inflow equivalent to the value of 42.9 tons of gold in the third quarter, after an outflow of 9.4 tons in the second quarter. The current investor sentiment, along with today's political landscape, may imply that the rise in gold prices may not yet be over.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

A Humble Mooer : no matter how many times the theory of monetarism is disproven in the real world there is no shaking it from simplistic analysis like this.

"When the growth rate of the money supply exceeds the growth rate of the actual economy, it means that the real purchasing power of money may decline"

thank you for at least putting in a may before decline.

IMO monetarism is the reason economics is a discredited field of scholarship.

105742796 Learner : Great

Guardian87 : intensive middle east wars

ztock_boy Guardian87 : [Commando] yes but countries with large gold reserves are not directly involved [Emoticon]

Alen Kok : ok

Adrianlim90 : a

Adrianlim90 : good

103677010 : noted

103677010 : noted

john song : gold is scarce

View more comments...