Traders Brace for Volatility and Shift from 0DTE Options Ahead of Jobless Claims Report

Traders, already unsettled by recent market swings, are preparing for more volatility in the coming sessions, starting with Thursday’s U.S. jobless claims report. Alongside this, there is a noticeable shift away from zero-day-to-expiry (0DTE) options, as market participants seek more enduring protection.

The options market is currently implying that the $S&P 500 Index (.SPX.US)$ could move 1.2% in either direction on the day of the report, based on the cost of at-the-money puts and calls, according to Stuart Kaiser, $Citigroup (C.US)$'s head of U.S. equity trading strategy. It aligns with the implied moves for August 14, the next reading on consumer prices, and August 29, the day after $NVIDIA (NVDA.US)$'s earnings report.

We remain surprised by the fast embrace of recession risks with the Atlanta Fed GDP tracking 2.9% and claims this Thursday will be very important,” Kaiser wrote in a note to clients. He added that the potential for significant market swings “also reflects the elevated level of short-dated implied volatility, so likely isn’t pricing explicit event risk as much as macro risk dynamics.”

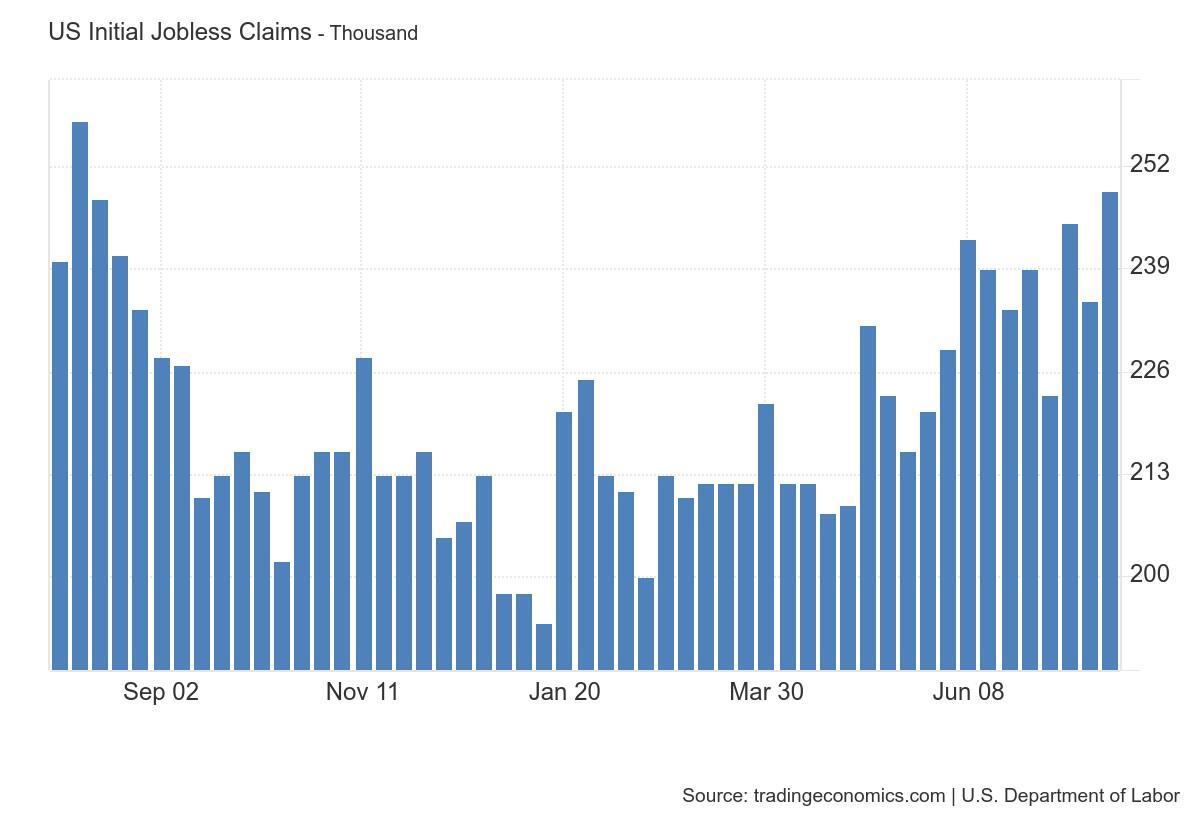

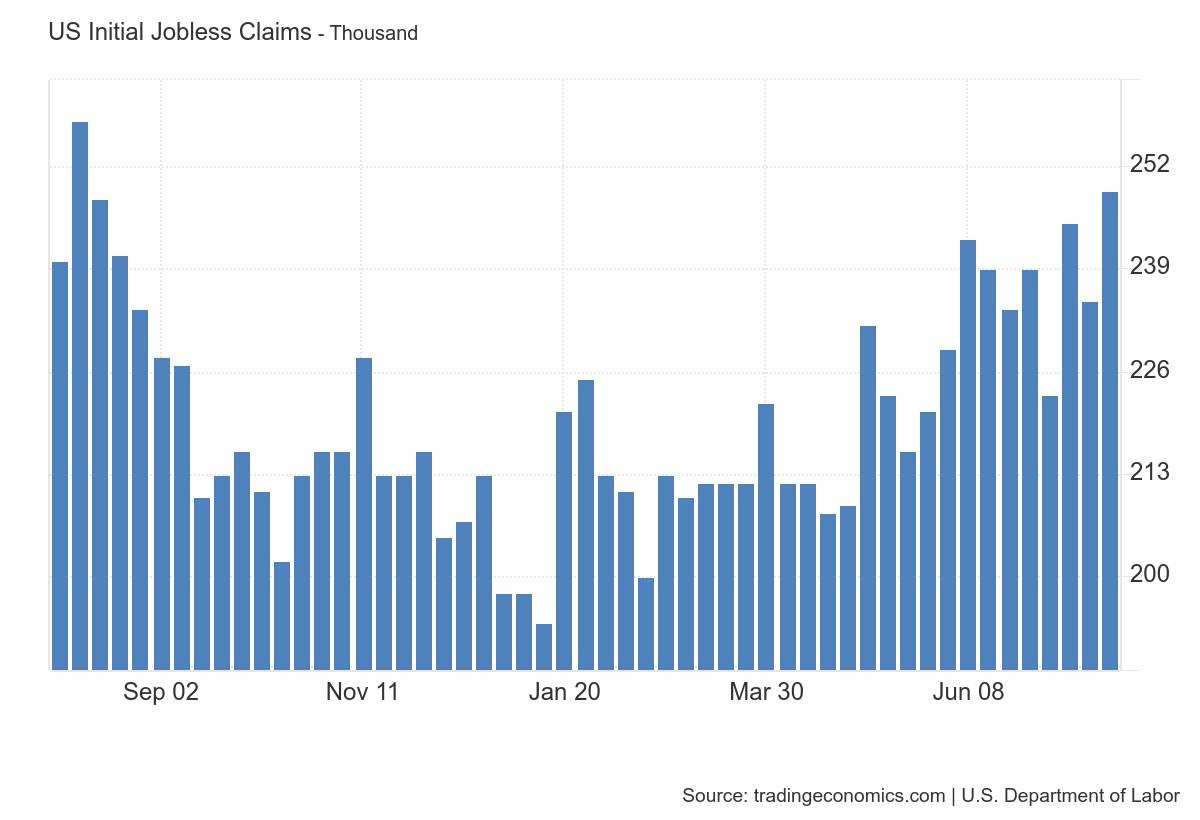

Traders are looking to the weekly jobless claims figures, due at 8:30 a.m. in Washington on Thursday, for further indications of whether the labor market is weakening. This follows the latest jobs report, which revealed the unemployment rate rose to an almost three-year high in July.

Volatility has already been heightened following a broad market selloff that briefly pushed the S&P 500 to the brink of a correction, defined as a nearly 10% drop from its July 16 all-time closing high. While the S&P 500 has since recovered some losses and currently sits about 6% away from its peak, traders are betting that a weakening labor market will put the Federal Reserve on a path to cut interest rates in September by almost half a percentage point. However, midweek trading saw some participants cashing in on futures and options bets for aggressive rate cuts this year.

Amid this backdrop, traders have notably turned away from 0DTE options—contracts that expire within the same day. These options, which have been popular since their 2022 launch and often account for more than half of daily S&P 500 options volume, were largely avoided during Monday’s market meltdown. On that day, the S&P 500 sank 3% and the $CBOE Volatility S&P 500 Index (.VIX.US)$ logged its largest intraday jump before closing at a four-year high. Consequently, the share of 0DTE options in total S&P 500 options volume fell to 26%, down from an average of 48% this year, per OptionMetrics data.

"What we've seen here is a shift from short-term hedges to people saying, 'oh, my gosh, I need something longer dated'," said Jim Carroll, portfolio manager at Ballast Rock Private Wealth.

Analysts attributed this move to several factors. The surge in volatility led options dealers to price 0DTE contracts at elevated levels to manage their own risk. This made longer-term contracts more appealing, as they offer more lasting protection despite also being pricey during the selloff. "The market seemed unable to price these options at such high levels of volatility," said Garrett DeSimone, head of quantitative research at OptionMetrics. "This would also explain the absence of volume."

Volume in short-dated contracts rebounded to about 42% the day after the selloff, as markets calmed, according to Trade Alert data. Nevertheless, the initial aversion to 0DTE options highlighted investors’ concerns about sustained volatility. "It's difficult to hedge longer-term risk with a one-day option,” said Craig Peterson, CEO of options research firm Tier 1 Alpha. “I think that's what's really been driving people back into those longer-dated tenors."

After rising by the most in nearly a year, initial jobless claims are forecast to fall by 9,000 to 240,000 in the week ended August 3, according to a Bloomberg survey of economists. The previous week's increase was largely attributed to annual auto-plant shutdowns and Hurricane Barry, with claims elevated in Texas—the state that bore the brunt of the first major hurricane of the season.

If jobless claims rise again, it could reignite concerns that the Fed might need to shift its focus to the employment component of its dual mandate, following the most disruptive monetary tightening campaign in recent memory to combat inflation.

“Recession odds are higher as U.S. economic data slows,” Kaiser added. “But the information received last week did not seem negative enough to justify the change in sentiment.”

Source: Bloomberg, Reuters

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

101550592 :