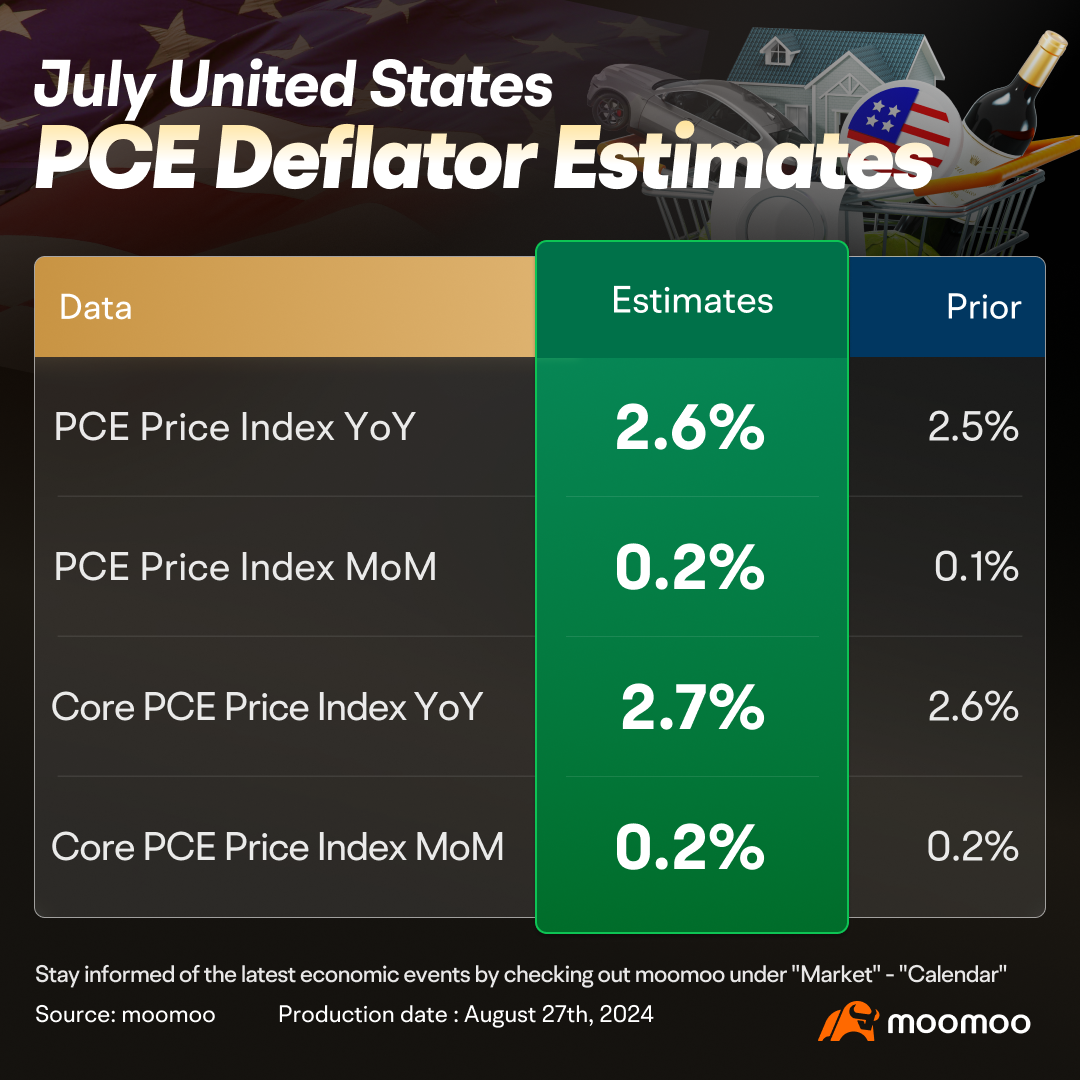

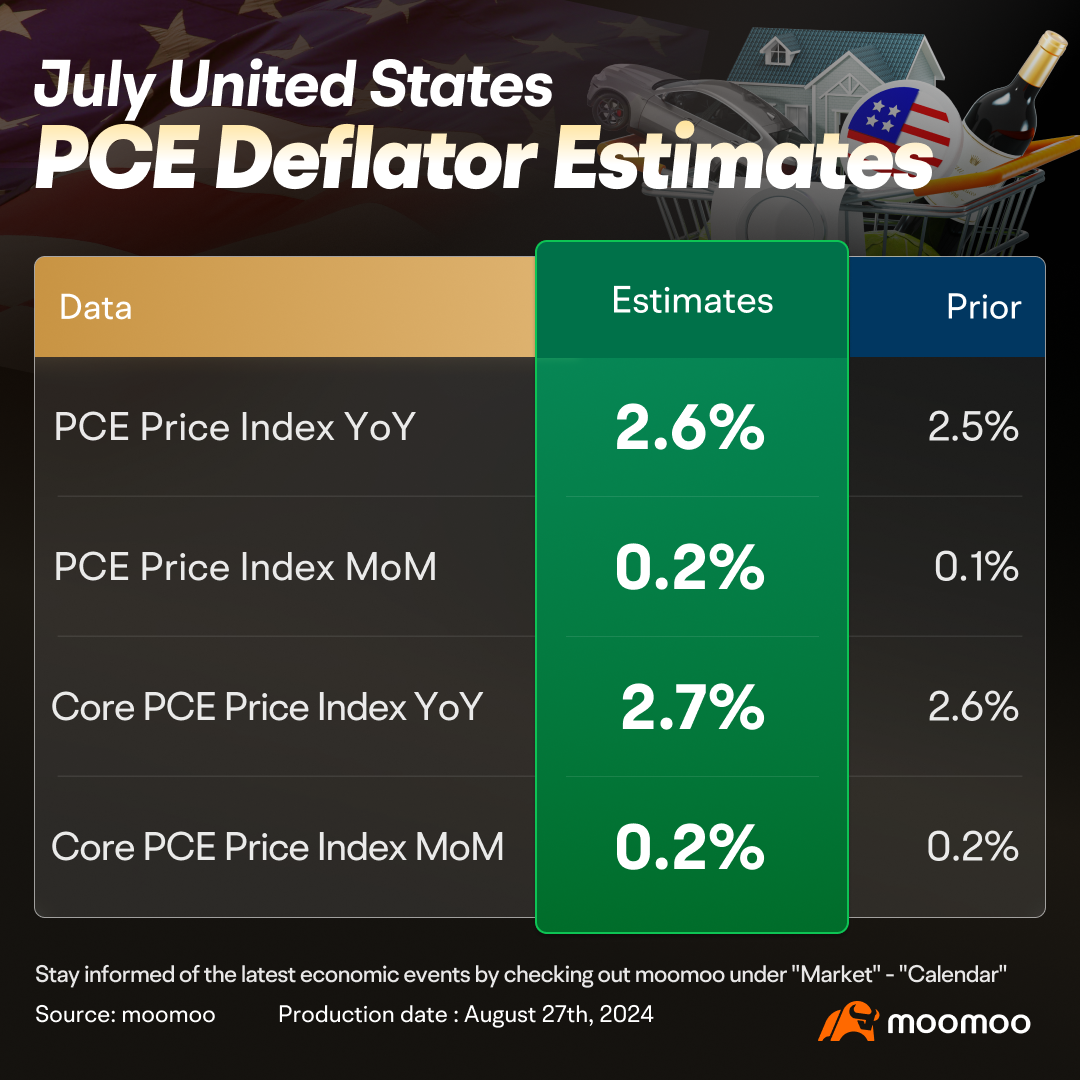

U.S. July PCE Preview | The Upcoming Inflation Data May Douse Expectations for Jumbo Rate Cuts

The Bureau of Economic Analysis will release the July Personal Consumption Expenditure and the price index at 8:30 ET on Friday.

Economists polled by Bloomberg expect core PCE inflation to remain at 0.2% in July, consistent with the Fed's annualized 2% inflation target for a fourth consecutive month. The year-over-year figure is expected to edge up to 2.7%. The headline PCE inflation growth rate will likely be 0.2%, and will likely increase to 2.6% on a year-over-year basis.

The primary drivers of July's core PCE figures were strong inflation in financial services and insurance, along with housing services. The disinflation of housing rents is progressing slower than hoped, whereas the market rally has continued to exert upward pressure on the financial service and insurance segments of the PCE.Another reason for the underlying increase in the PCE price index is the low base in July last year.

In addition, economists anticipate that the personal savings rate will drop further to 3.0%, down from 3.4% in June, based on forecasts for PCE spending and income. Aside from a period in mid-2022, the last instance when the savings rate approached this level was in August 2008, when it stood at 3.1%.

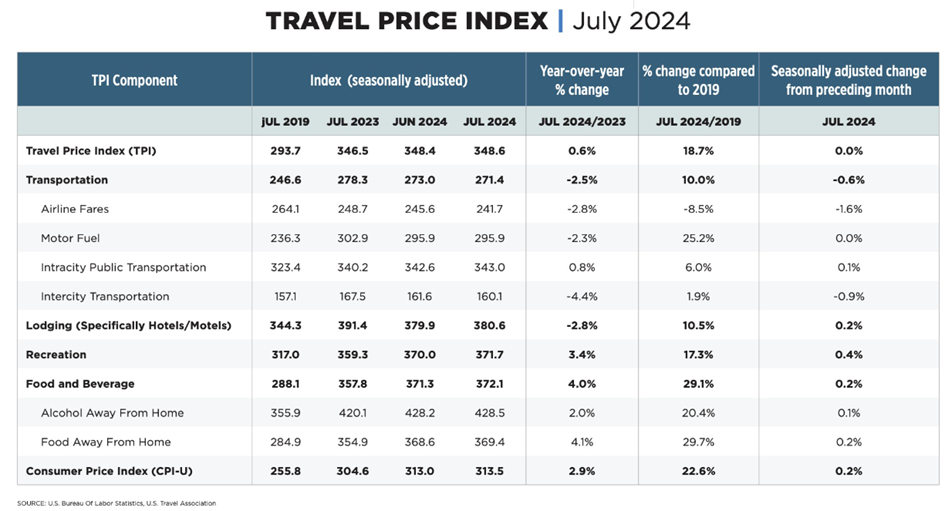

▶ Travel prices remained the same as last month, which may stabilize core service prices

The U.S. Travel-calculated Travel Price Index (TPI) reveals that travel prices in July remained unchanged on average from the previous month. Airline fares decreased by 1.6%, while other travel-related expenses, including lodging, transportation, and dining out, increased at rates comparable to or lower than the general economic trend. Although recreation costs experienced a slightly higher growth rate than the overall prices both monthly and annually, they have shown a slower rise compared to the pre-pandemic period.

▶ Rising consumer spending and slowing income growth may cause the savings rate to decline

Despite a faltering job market, consumer spending has remained robust. Retail sales jumped an impressive 1.0% in July, representing a 25% increase from the total gains of the previous two years—all in a single month. Moreover, the latest Quarterly Services Report indicates that service consumption in Q2 was even stronger than initially estimated.

Wells Fargo predicts that overall personal spending will rise by 0.5% in July, potentially the highest increase in four months. However, the sustainability of this spending growth hinges on household income. With liquidity no longer plentiful and a slowdown in revolving credit use, future spending will likely depend on income growth, which is decelerating. Given the cooling labor market, this could pose challenges for consumers. Economists anticipate a modest 0.1% increase in personal income for July, a rate that lags behind spending. This disparity suggests that the personal saving rate, which already reached its lowest point in 18 months in June, might drop further.

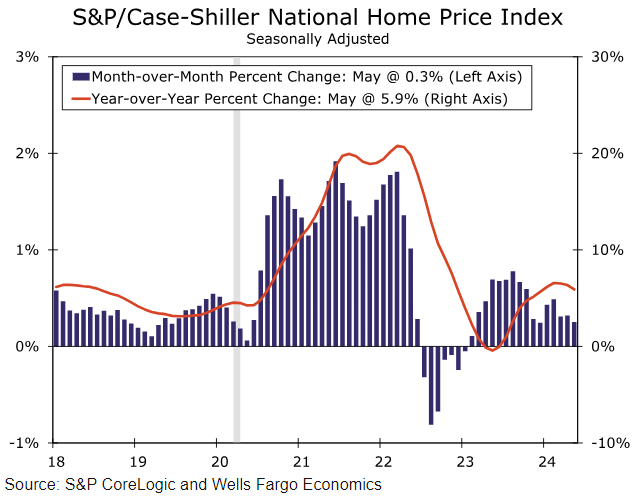

▶ House prices rose on expectations of interest rate cut

As the FOMC begins to implement rate cuts, it may face a distinct challenge in the housing market. Average House Prices in the United States increased to $514800 in July from $487200 in June of 2024. Rising home prices may make the Fed think a soft landing is more likely than a hard landing. Hence, the Fed may proceed with incremental rate cuts and resist push for jumbo rate cut.

▶ What's the implication for the Fed?

Although the market has fully priced in that the Federal Reserve will enter a rate-cutting phase in about 20 days, the upcoming inflation data may lead the market to give up expectations for a half-point rate cut. This also means that interest rates may not return to a range that makes consumers feel comfortable in the short term. At the same time, seasonal patterns in the stock market show that September is often one of the weaker months of the year. Therefore, the stock market has a low tolerance for errors in the macroeconomic data over the next month, and any unusual changes could lead to dual interpretations and market repricing.

Source: FRED, CME, Wells Fargo

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Laine Ford : money stock

151390495 : I'm trying to improvisation

151390495 : CTBAAU25S