Unveiling the Japanese Stock Market: Is the Recent Pullback an Opportunity to Buy?

Japanese stock prices dropped by 2.19% on Monday, concurrently with the yen approaching highs not seen in a month. There is a growing anticipation among some economists that the BOJ is on the verge of moving away from its extremely accommodative monetary policy, including negative interest rates and yield curve control, with a possible announcement at its next meeting.

Policymakers are considering the move on expectations of steep increases in wages this year. An upward revision in gross domestic product (GDP) data on Monday- which showed the Japanese economy avoided a technical recession in the fourth quarter- also factored into fears of an early BOJ pivot.

Still, the Nikkei 225 Index has risen 16.62% this year. The gains in Japanese stocks were attributed to strong earnings growth, expectations for salary increases, reshoring of investment from local companies and technological innovation. After two years of huge gains, are Japanese stocks still a buying opportunity for investors?

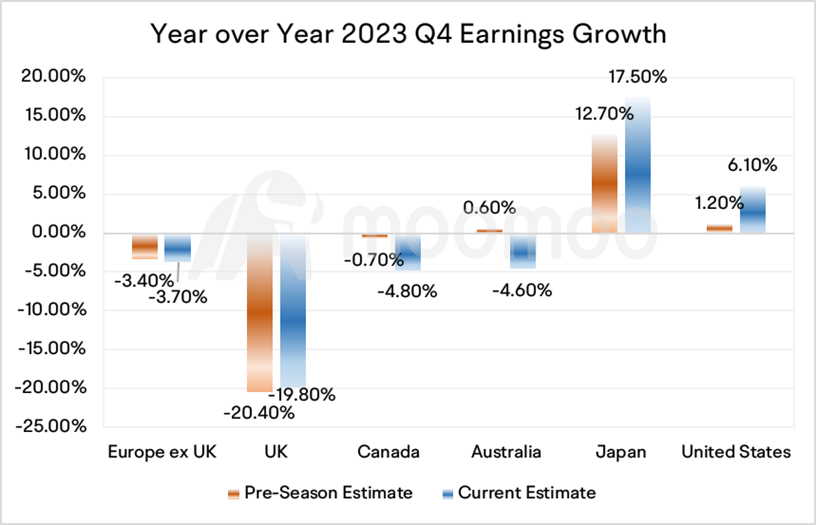

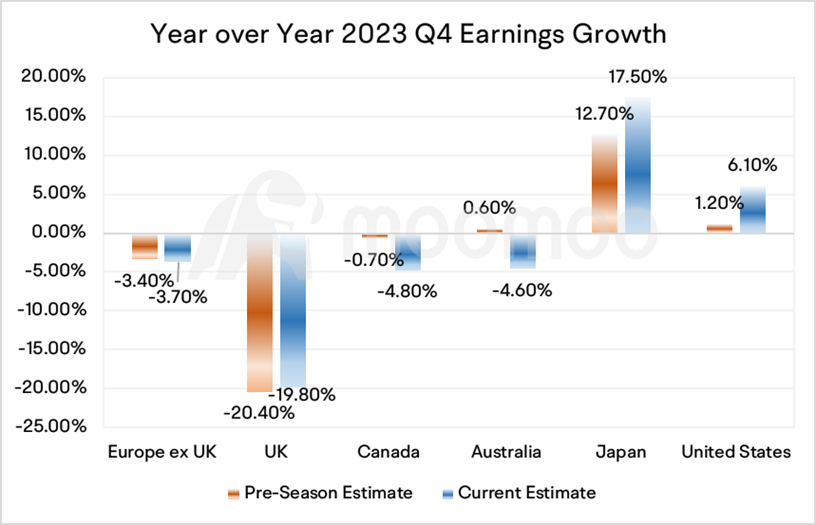

■ Japanese stock earnings growth reached 17.5% in Q4 2023

Japan stands out as the sole advanced economy, apart from the United States, to record an increase in earnings for the fourth quarter of 2023 compared to the previous year, surpassing high expectations of double-digit growth. Meanwhile, the United Kingdom is poised to experience the most significant decline in earnings. Within Japan, strong earnings outperformance in the financials, consumer staples, and industrial sectors has more than compensated for the shortcomings and downward revisions in the communication services sector.

From the perspective of the percentage of performance exceeding expectations, leading companies in Japan and the United States recorded the highest proportions of firms surpassing 4Q consensus estimates, with 81% in Japan and 89% in the US respectively. In comparison, the United Kingdom ranks as the sixth lowest-performing market, with a mere 43% of its stocks exceeding expectations.

■ Japanese stock market P/E ratio looks reasonable

From a forward 12-month P/E perspective, the valuation of the Japanese stock market is slightly higher than the average level of major countries, but its P/B and P/S valuations are lower than other markets. The dividend yield on the Japanese stock market is 1.98%. Although Japan stock market forward P/E has expanded more than 15% year to date, stock market valuations still look reasonable given the pace of earnings growth.

■ Japan may lead in stabilizing inflation within the target range

The core consumer price index in Japan, which excludes fresh food but includes fuel costs, rose 2% in January 2024, slowing from a 2.3% gain in December and posting the lowest reading since March 2022. Japan’s core inflation print is now within the central bank’s 2% target after exceeding that level for 21 consecutive months. Even though the Tokyo CPI, which was announced before the national index, rebounded in February, inflationary pressure after excluding food and energy is still decreasing.

Rising wages and lower inflation could make Japanese residents' balance sheets stronger. As a non-resource-based country, Japan is highly dependent on commodity imports. Falling inflation also gives hope for a rebound in corporate profits.

■ Japan's wage growth accelerates again

On March 7th, Japan's average pay hike demands top 5% for the first time in 30 years. The weighted average of wage hikes requested by 3,102 member unions of the Japanese Trade Union Confederation, or Rengo, in this year's shuntō labor-management negotiations came to 5.85%, preliminary data showed Thursday.

Wages growth would spur stronger consumption, causing growth and inflation to exceed forecasts - prompting an earlier shift in BOJ policy. Rising costs of living and labor shortages mean firms might need to be generous to secure scarce workers.

■ Influx of international talent and investment fuels Japan's economic rebound

Changes in the rules to allow more workers from other countries will help make up for the decrease in the workforce caused by a falling population. Companies that boost investments in local supply chains to minimize geopolitical threats and that invest in emerging technologies to gain a foothold in new markets are likely to enhance capital accumulation and improve productivity.

■ What role will Japan play in the AIera?

The demand for chips spurred by AI will fully benefit all sectors of semiconductor manufacturing. Japan has a strong presence in the materials and precision equipment used in semiconductor manufacturing.

Materials: Companies like Shin-Etsu Chemical and Sumco are leading suppliers of silicon wafers, while Tokyo Electron and Screen Holdings provide semiconductor production equipment.

Photolithography Equipment: Companies such as Nikon and Canon are renowned for their precision photolithography equipment, which is crucial for the semiconductor manufacturing process, particularly in patterning intricate circuit designs onto silicon wafers.

Inspection and Testing Equipment: Advantest is a global leader in semiconductor testing equipment, providing advanced testing solutions for ensuring the performance and reliability of semiconductors.

Chemical Vapor Deposition (CVD) Equipment: Japan has strong offerings in CVD equipment, which are used to deposit thin films and various materials onto semiconductor wafers.

In the Nikkei 225 Index, the technology industry accounts for the highest proportion, making up 24.23% of the index.

Source: Statistics Bureau of Japan, trading economics, Bloomberg

By Moomoo US Calvin

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Waikey Phoon : Cannot buy by using ur app![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)