US August CPI Preview | Why Falling Inflation Can't Please Investors Anymore

On September 11, the U.S. Bureau of Labor Statistics will release CPI data for August at 8:30 a.m. ET.

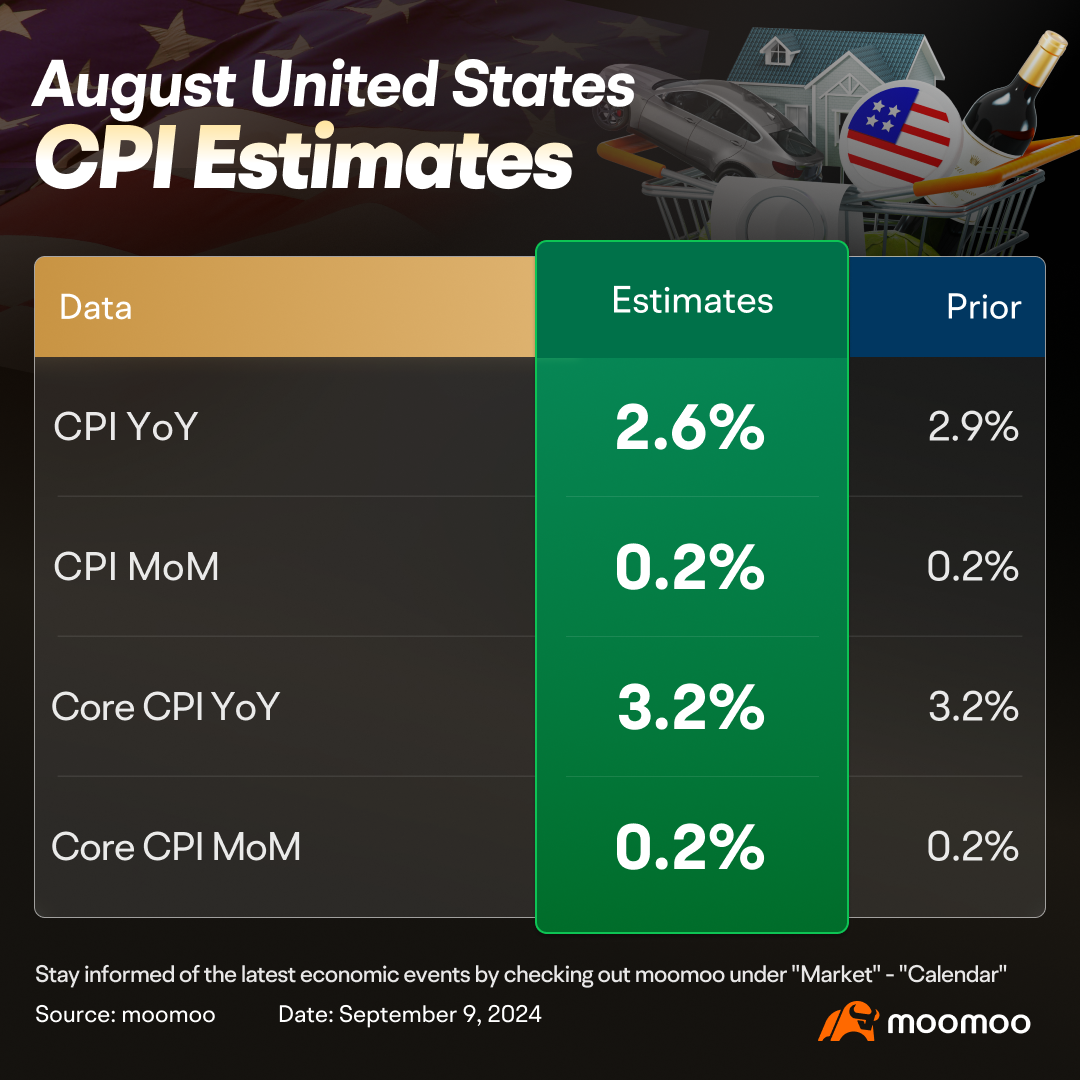

Economists expect the overall CPI to rise by 0.2% in August, which will bring the annual rate to 2.6%, the lowest level after March, 2021. The core CPI is also expected to increase by 0.2% in July. The 12-month change rate of the core CPI is expected to remain at 3.2%.

▶ Non-core inflation is anticipated to see a faster decline

1) Oil prices have fallen sharply since mid-August

The average crude oil price stands at $78.12 in August, a decrease from $83.26 compared to previous month and $84.72 a year ago, reflecting a monthly change of -6.17% and an annual change of -7.79%.

Disappointing labor market data of nonfarm payrolls reinforced fears of a slowdown in the US. Weaker economic data from Europe further amplified worries about declining energy demand. In response, Bank of America has adjusted its 2025 oil price forecast, reducing the expected price of Brent to $75 from $80 and the U.S. benchmark to $71 from $75. Moreover, Saudi Aramco's recent decision to lower its official selling prices for October suggests anticipated weak demand in Asia.

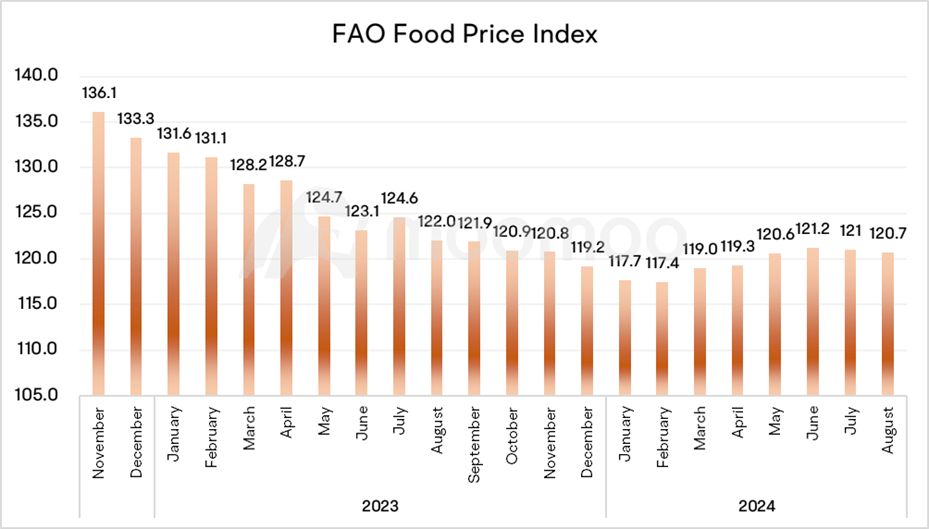

2) Food inflation eased in August

The FAO Food Price Index was at 120.7 points in August 2024, slightly lower than its revised July figure. The index for August was 1.1% below the same month last year and 24.7% beneath its peak of 160.3 points from March 2022. Sugar price plummeted by 23.2% from its value a year ago, driven by the improving production outlook for the 2024/25 season in Southeast Asia, following favorable rainfall that benefited sugarcane crops.

▶ Core inflation is decreasing at a slower pace but nearing the Fed's target

1) Rent prices declined following the seasonal pattern

Apartment List’s National Rent Report indicates a slight decrease of -0.1% in average rent for August compared to the previous month, maintaining a year-over-year decline of -0.7%. This marks the 15th consecutive month of negative growth.

In terms of cities, 59 out of the 100 biggest cities saw rent reductions in August, mirroring the national pattern. Year-over-year, 52 of these cities experienced negative rent growth. The most significant annual declines were notably in Sun Belt cities like Austin (-7.5%), Raleigh (-5.6%), and Atlanta (-4.9%), which continue to expand their multifamily housing stocks.

2) Used car prices bottomed out in August.

According to Cox Automotive, wholesale used-vehicle prices were higher in August compared to July. The Manheim Used Vehicle Value Index rose to 203.9, an increase of 1.1% compared to July, and a decline of 3.9% from a year ago.

Jeremy Robb, senior director of Economic and Industry Insights at Cox Automotive, noted, "We observed that the trend of increasing wholesale values carried over from July into August, with prices appreciating each week, except the last one. Sales conversion rates also escalated, maintaining much higher levels compared to previous years throughout the month, as more buyers entered the market to restock used retail inventories. Given that lease maturities are decreasing and the supply of used retail days has tightened over the past month, we anticipate continued pressure on buyers in the upcoming weeks."

▶ What's the implication?

The CME FedWatch tool shows the probability of a 25-basis point rate cut in September has risen to 73%. Despite last week's nonfarm payroll data falling below expectations, the market has reduced bets on a 50-basis point rate cut. This suggests that minor fluctuations within a reasonable range of economic data have a limited impact on the Federal Reserve's policy path. Considering that other countries that have started cutting rates are doing so at a pace of 25 basis points, the Fed may not adopt a more aggressive easing policy.

However, although the upcoming report can convince the Fed to cut rates, it might not convince the stock market investors.

It appears that the market is not satisfied anymore, no matter how much the inflation has been since recent months. Contrary to the situation a year ago, when declining inflation typically led to a rise in the market, current trends do not follow this pattern. The market direction in history has been influenced by broader factors such as corporate earnings and liquidity, not sorely by inflation. Besides, since the market has already fully priced in the upcoming rate cut, the room for positive imagination on the policy front is limited. Therefore, investors have become increasingly insensitive to recent inflation data.

There are other risks worth noting currently. For example, the US dollar is weakening, with the dollar index reaching its lowest level in a year at the end of August, indicating a decline in U.S. purchasing power. Additionally, as inflation eases, shortages of some products seen during the pandemic are abating. This means that both corporate profits and wage increases may be impacted. As the path of monetary policy becomes a foregone conclusion, the "dark sides" behind the economy have become the reasons why falling inflation can't please investors anymore.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

151350542 : Sensible and good article.

It firstly and rightly emphasises the diminishing returns of lower inflation (hence corporate pricing power), and elevates the risk of a deceleration of economic and corporate earnings growth.

The key to the above puzzle is whether the Fed’s monetary policy, government spending and/or technological innovations can unlock the growth potential in the US in the coming 12-18 months.

If one wants to place bets on how these factors will affect growth in the US, in my humble opinion, one would lean towards the upside.

151350542 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)