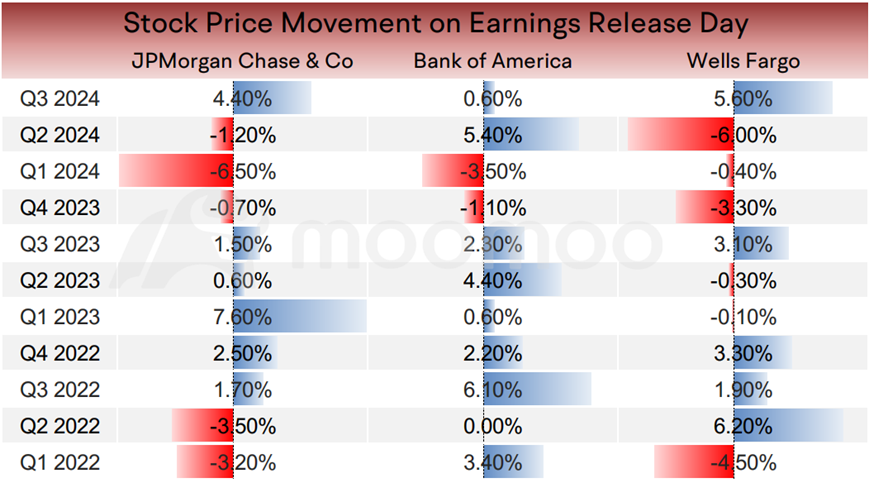

U.S. Bank Q3 Earnings Summary | First Quarterly Reports After Rate Cut Reveal Remarkable Resilience

The U.S. stock earnings season kicked off last Friday. Multiple U.S. commercial banks exceeded earnings expectations and saw their stock prices rise following the release of their financial reports..

This upward trend validates our September 20th topic: "U.S. Commercial Banks Will Directly Benefit from the Rate Cuts. Here's How." The macroeconomic environment before and after rate cuts remains favorable for the banking sector. Banks are currently benefiting from still-high interest income while also generating more investment banking and asset management revenue due to increased capital market activity brought on by rate cuts.

However, from the perspective of a longer cycle, the deeper reason is that U.S. real estate is still in a major upward cycle overall. With the expectation and reality of Fed rate cuts, real estate has also experienced a FOMO (Fear of Missing Out) phenomenon. As a result, even with high interest rates, buyers have already started to leverage up and purchase homes in advance, allowing banks to benefit long-term from this real estate wave.

Here's the summary of the banking sector's indicators for Q3:

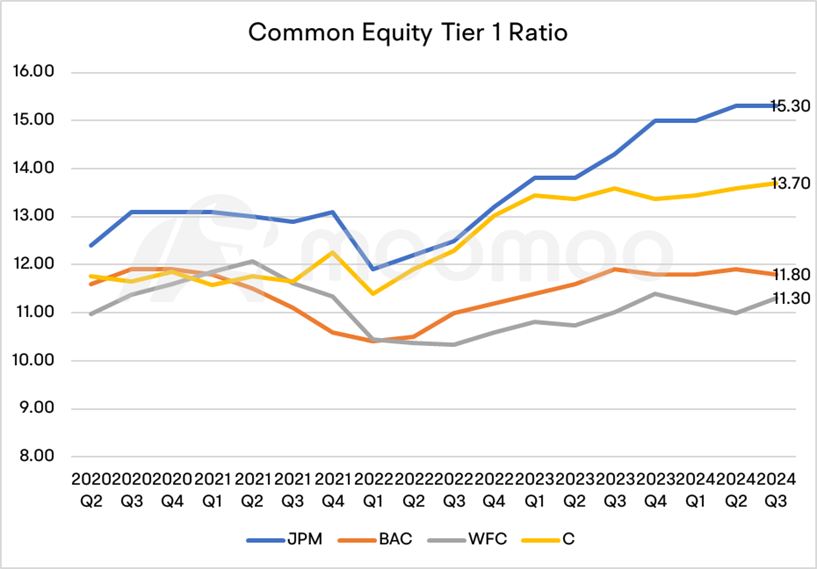

1. The capital adequacy ratio continues to rise

JPM's CET1 ratio reached 15.30%, and Citigroup's CET1 ratio rose to 13.70%. A rising CET1 means banks have more core tier 1 capital relative to their risk-weighted assets, indicating more retained earnings, a more conservative lending portfolio, and a better ability to withstand potential financial risks.

2. Non-performing loan ratios are overall steady

In the third quarter, JPMorgan, Bank of America, and Wells Fargo each reported an increase in loan charge-offs compared to last year. This trend was particularly noticeable in their credit card portfolios. However, the non-performing loan ratio remains below 1%, within a controllable range.

Although years of inflation have strained U.S. residents' financial situations, factors such as rising house prices, appreciation of other assets' wealth effect, and income growth outpacing inflation have kept overall resident repayment capacity stable.

3. Interest margins declined, but less than expected

Major banks' net interest margins are in the upper-middle range of the past five years. Despite a slight decrease, the rebound in loan growth has offset potential reductions in interest income.

During the third quarter, a trend persisted where customers shifted their deposits to higher-yielding options like Treasuries and money-market funds. This movement has compelled banks to offer more competitive rates to attract and retain deposits, which in turn has impacted their profit margins.

However, there are signs of this trend slowing down. Both JPMorgan Chase and Wells Fargo have reported observing a deceleration in this deposit migration.

Jeremy Barnum, JPMorgan's Chief Financial Officer, provided insights on this matter. He stated that the bank believes the pressure on certificates of deposits has likely reached its peak. While he doesn't expect interest rates to return to zero, Barnum anticipates that the pressure will continue to ease as overall rates decrease.

4. Household spending continues to show strength

Citigroup observed continued growth in spending, albeit at a "moderate pace," according to Chief Financial Officer Mark Mason.

Mason characterized consumers as "broadly healthy and resilient, but more cautious." He noted a disparity in spending patterns across income levels. Higher-income consumers are leading the growth in spending; middle-income households are becoming "more selective" in their expenditures, and lower-income consumers are experiencing financial pressure.

Bank of America also reported an increase in consumer spending compared to the previous year, aligning with similar findings from JPMorgan Chase and Wells Fargo. Total payments, including credit, debit, cash, checks and other transactions, showed a year-over-year increase.

▶ Financial stocks often perform well in the context of rate cuts and a soft landing

Wells Fargo previously stated that rate cuts without an economic recession historically benefit bank stocks. For instance, in 1995, 1998, and 2019, rate cuts stimulated rises in U.S. bank stocks. In the context of an economic soft landing, U.S. bank stocks' quarterly gains following the first rate cut typically exceed the S&P 500 index by nearly 10%. Last Friday, Apollo Global Management analyst Torsten Slok told the media that financial stocks have always been one of the best-performing sectors during rate-cut cycles that end with a "soft landing."

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Alice Lim choo :

muhamad Hazairudin s : $Proshares Trust Pshs Ult Semicdt (USD.US)$ Muhammad hazairudin shadan

Alen Kok : good

54088 FROM MBS : 3299

samZai :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

103677010 : noted