US June PCE Preview: The Upcoming Price Index Will Reinforce Expectations of a September Interest Rate Cut

The Bureau of Economic Analysis will release the Personal Consumption Expenditure and the price index at 8:30 ET on Friday. As high financing costs begin to affect consumer behavior, demand for leisure spending and interest-sensitive durable goods is likely to slow significantly.

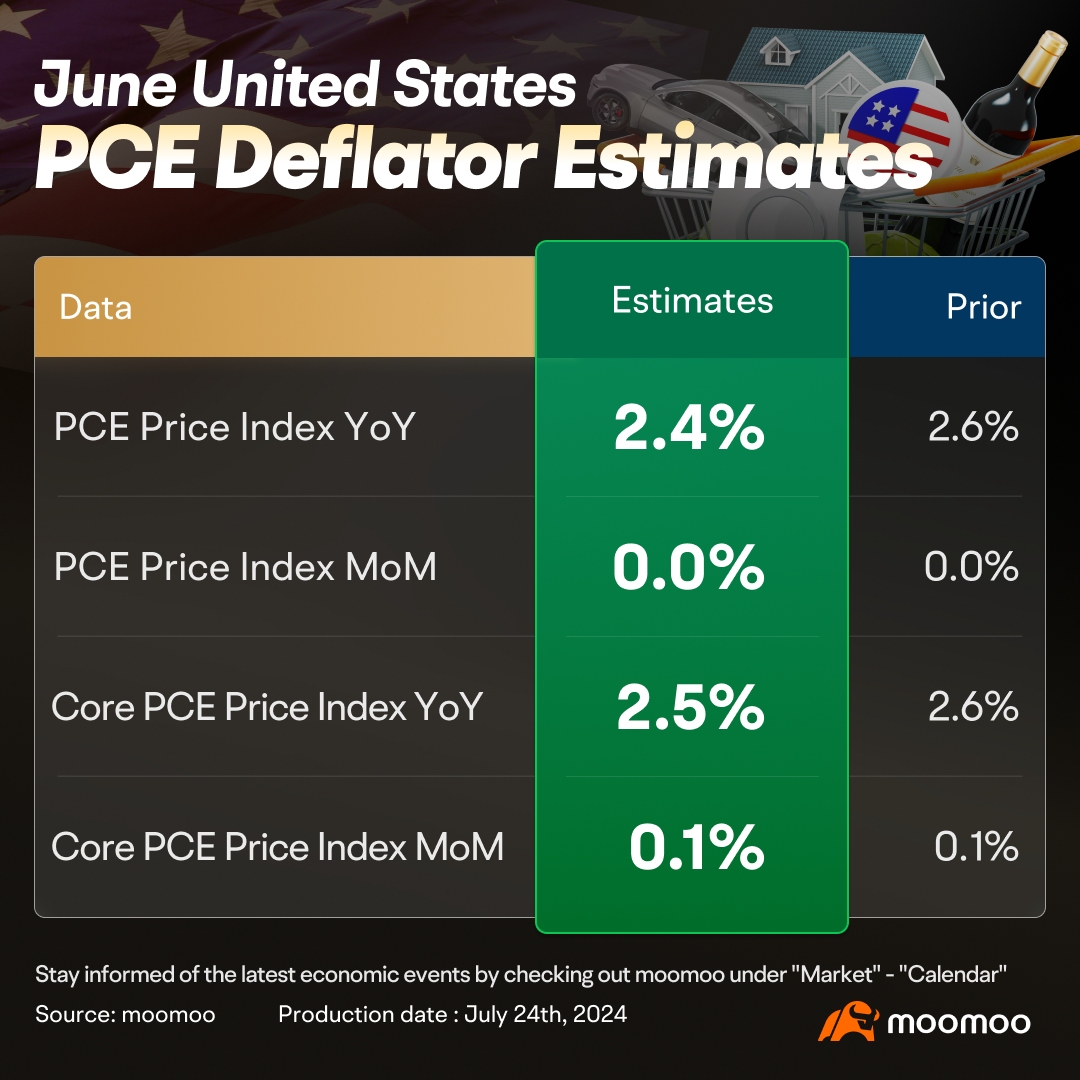

Both the headline and Core PCE deflators are anticipated to make further progress as the momentum of inflation weakening extends beyond the commodity sector. Economists polled by Bloomberg expect core PCE inflation to remain at 0.1% in June, with the year-over-year figure dropping to 2.5%, the lowest since April 2021. Headline PCE inflation growth rate will likely be 0.0%, and will slow down to 2.4% on a year-over year basis.

■ Decreasing travel prices likely to push core services inflation down

According to U.S. Travel Association, the overall cost of travel is down 2% from the same month in 2023, led by lower airline, hotel, and gas prices. Among all expenses, air tickets have fallen the most, decreasing by 5.1%. And when compared to pre-pandemic prices, airfares also decreased — by an even larger margin of 6.3%. Besides, with the saturation of employment in the service industry, the salary burden on employers is easing.

■ Personal income and outlays might be moderately growing in June

Personal income and outlay data will also be released on Friday. Slower hiring and wage growth likely limited personal income growth to 0.4% in June, compared to 0.5% in May. That will be consistent with nonfarm payrolls hourly wages trend. Data released earlier this month showed that average hourly earnings increased by 3.86% in June, the slowest since May in 2021.

Personal outlays could be moderate as well since U.S. retail sales released last week were unchanged in June as a decrease in receipts at auto dealerships was offset by broad strength elsewhere. Sales at gasoline stations were down 3% and those for autos declined 2.3%. Economists predict personal outlays, to be released by Bureau of Economic Analysis, is likely to increase by 0.3% in June.

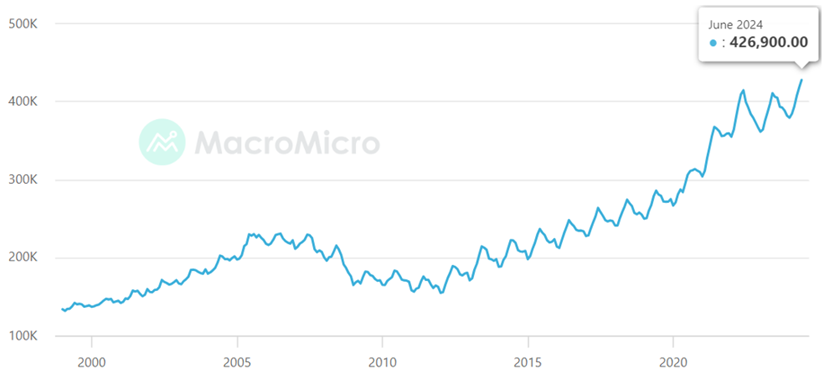

■ Existing home sales prices continued to rise despite high interest rate

The median existing home price increased by 4.1% from a year earlier to an all-time high of $426,900. Although home prices have reached new peaks for two consecutive months, the growth rate has decelerated as the housing supply approaches its highest level in nearly four years.

The impact of rising housing prices may not be reflected in the PCE price index in the short term; however, once rents also start to increase, it could lead to a rebound in inflation next year.

■ What's the implication for the Fed?

The Fed chair Powell stated last week that the central bank will not wait until inflation hits 2% to cut interest rates. “Our test has been for quite some time that we want to have greater confidence that inflation was moving sustainably down towards our 2 per cent target, and what increases confidence in that is more good inflation data. And lately, we have been getting some of that.” He said.

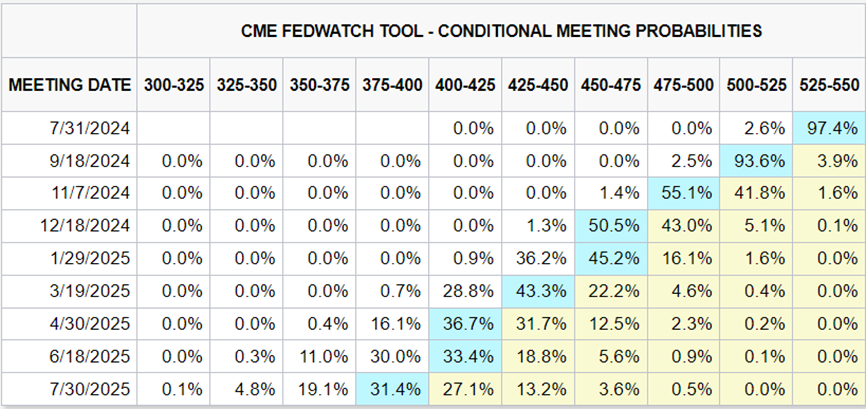

The market has also become more dovish than it was the last time PCE was announced. CME FedWatch currently shows that the probability of a rate cut in September is as high as 96.1%, while the probability was only 64.1% a month ago.

Therefore, the release of this PCE data will have a greater impact on whether and when the second interest rate cut after September occurs.

Source: FRED, CME

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

affable Blobfish_403 : The consequences of political interest rate cuts are endless, especially when GDP soars and the number of people receiving initial unemployment benefits plummeted.

104476495 : hi

103677010 : noted