Westpac Banking Corporation H1 2024: A Steady Contender in a Tough Market,Special Dividend and $1B Buyback

As the fiscal tempests blow, Westpac Banking Corporation (WBC) $Westpac Banking Corp(WBC.AU$ presents its H1 2024 results, revealing a vessel that has weathered recent financial squalls with commendable steadiness. Despite market unpredictability, WBC's performance suggests a stabilizing force in the banking sector. The financial outcomes, characterized by stable capital indicators and enhanced shareholder returns, signal a potentially brighter horizon. Yet the bank is not without its challenges, particularly in how it projects future expenses. With the stock already up 20% this year, the question for investors is whether to sail along with Westpac or anchor their funds elsewhere.

**Steady as She Goes: Revenue and Net Operating Income**

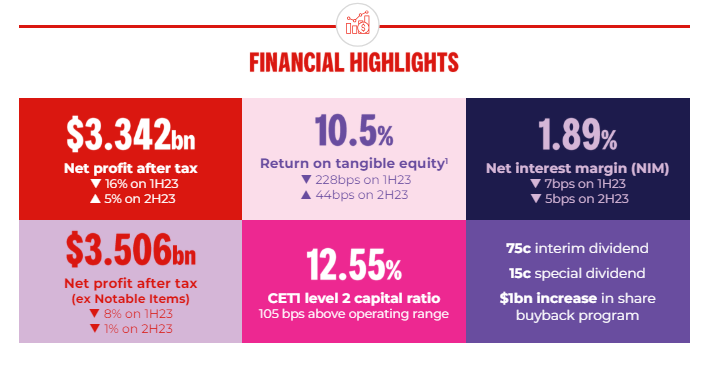

Westpac's net operating income has seen a modest 4% year-over-year drop to $10,590 million, attributed to a flat net interest income and a notable decline in non-interest income.

Despite these figures, the Business & Wealth division has emerged as the fleet's flagship, boasting a 7% net profit increase. This sector's robust performance, particularly in commercial property and agribusiness lending, is a testament to Westpac's strategic focus and market acumen.

The Institutional Bank sails on with a modest 3% profit dip, its robust loan growth boding well for future voyages. Westpac's New Zealand arm reports a profit swell, although this is somewhat tempered by rising operational costs. The Australian Consumer business, however, faces headwinds, with a significant profit drop driven by mortgage price competition. Yet, there are signs of easing, suggesting that the worst may be past and smoother sailing lies ahead.

**Navigating Costly Waters: Operating Expenses on the Rise**

An 8% uptick in operating expenses reflects the broader economic narrative of inflationary pressures. Yet, Westpac's prudent cost management strategies have provided a buffer against these headwinds, evidenced by a reduced impairment charge. This is indicative of the bank's rigorous credit risk oversight, a crucial anchor for future financial stability.

A substantial under-spend on investment expenditures points to a significant uptick in the second half of the year. Clear communication from management regarding this future spending will be critical to maintain investor trust and to ensure that the market accurately prices in these future costs.

**Profitability in Choppy Seas: Dividend and Shareholder Value**

Despite a decline in overall profit, Westpac's commitment to its shareholders remains unwavering. The board's decision to increase the fully franked interim dividend to 75 cents per share, supplemented by a special dividend, is a strong vote of confidence in the bank's resilience and strategic direction. This approach, along with an increase in the share buyback program to AUD 2.5 billion, up from the original plan of AUD 1 billion. The interim dividend stands at 75 cents per share, fully franked, representing an increase of 5 cents per share, or approximately 7%, over the 2023 interim dividend.

Conclusion:

In the final analysis, Westpac Banking Corporation's H1 2024 performance paints a picture of stability amidst a sea of challenges. The bank's ability to maintain a steady course through economic turbulence is laudable, with capital returns and dividends as the standout beacons.

However, the forecast on costs remains cloudy, and management's ability to effectively communicate their strategy will be pivotal. With the stock's significant rise, investors should weigh the potential for continued growth against the risks of an uncertain economic climate. For those considering boarding the Westpac ship, it may be wise to observe the coming wave of investment expenditures before setting sail on an investment decision.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment