What Message Will Powell Convey in His Speech at the Jackson Hole Economic Symposium?

Jerome Powell, the Chair of the Federal Reserve, is scheduled to deliver a speech at 10:00 a.m. Eastern Time on August 23 during the annual Jackson Hole Economic Policy Symposium, hosted by the Kansas City Federal Reserve, as announced by the US central bank on Thursday. This year's conference is slated for August 22-24 and will take place at Jackson Lake Lodge in the scenic Grand Teton National Park. The subject of this year's Jackson Hole gathering will be "Reassessing the Effectiveness and Transmission of Monetary Policy."

As the Federal Reserve stands on the verge of reducing interest rates, which are currently at their highest in over two decades, all eyes will be on Powell's speech for subtle clues about his perspective on the economy, especially after a jobs report that fell short of expectations and a continued softening of inflation.

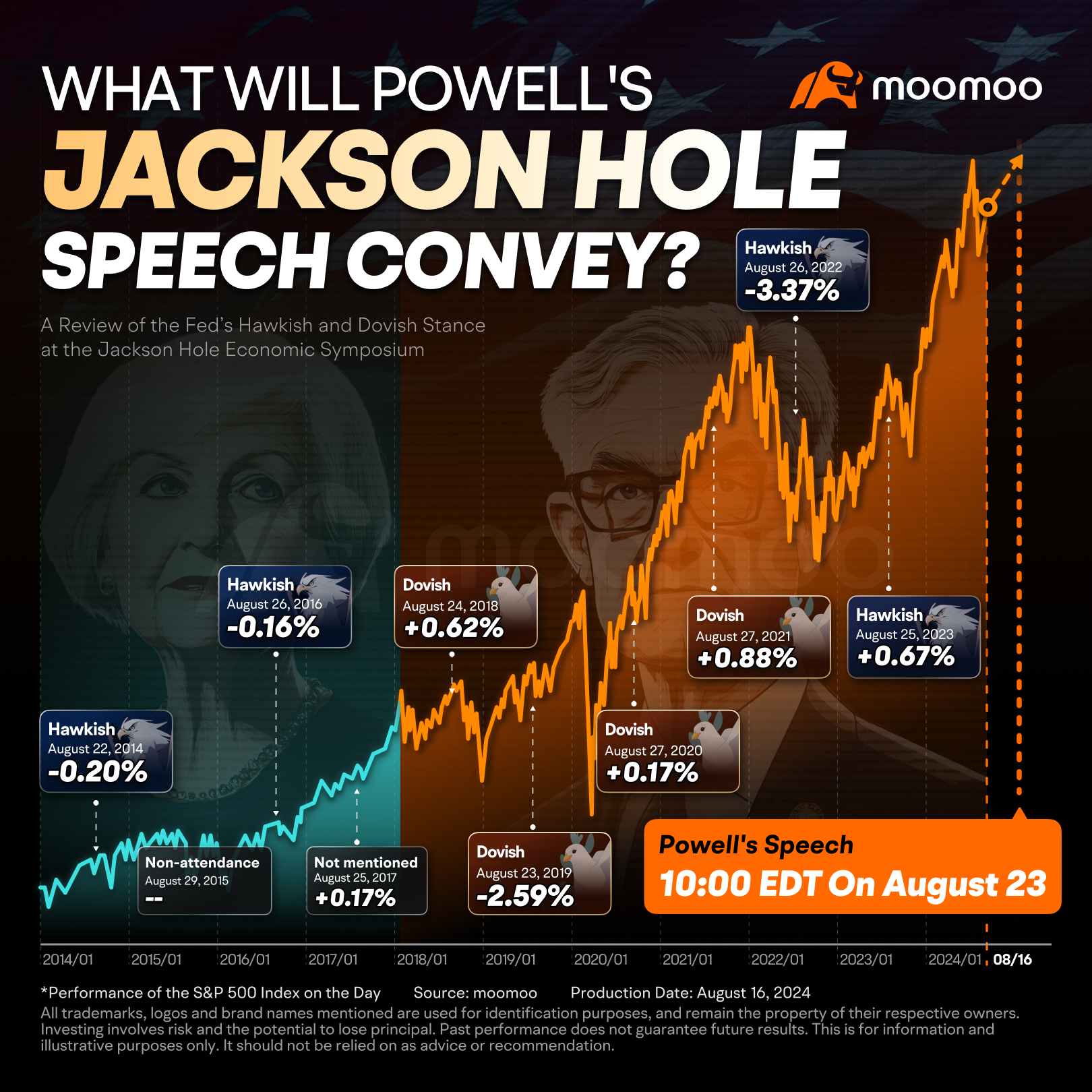

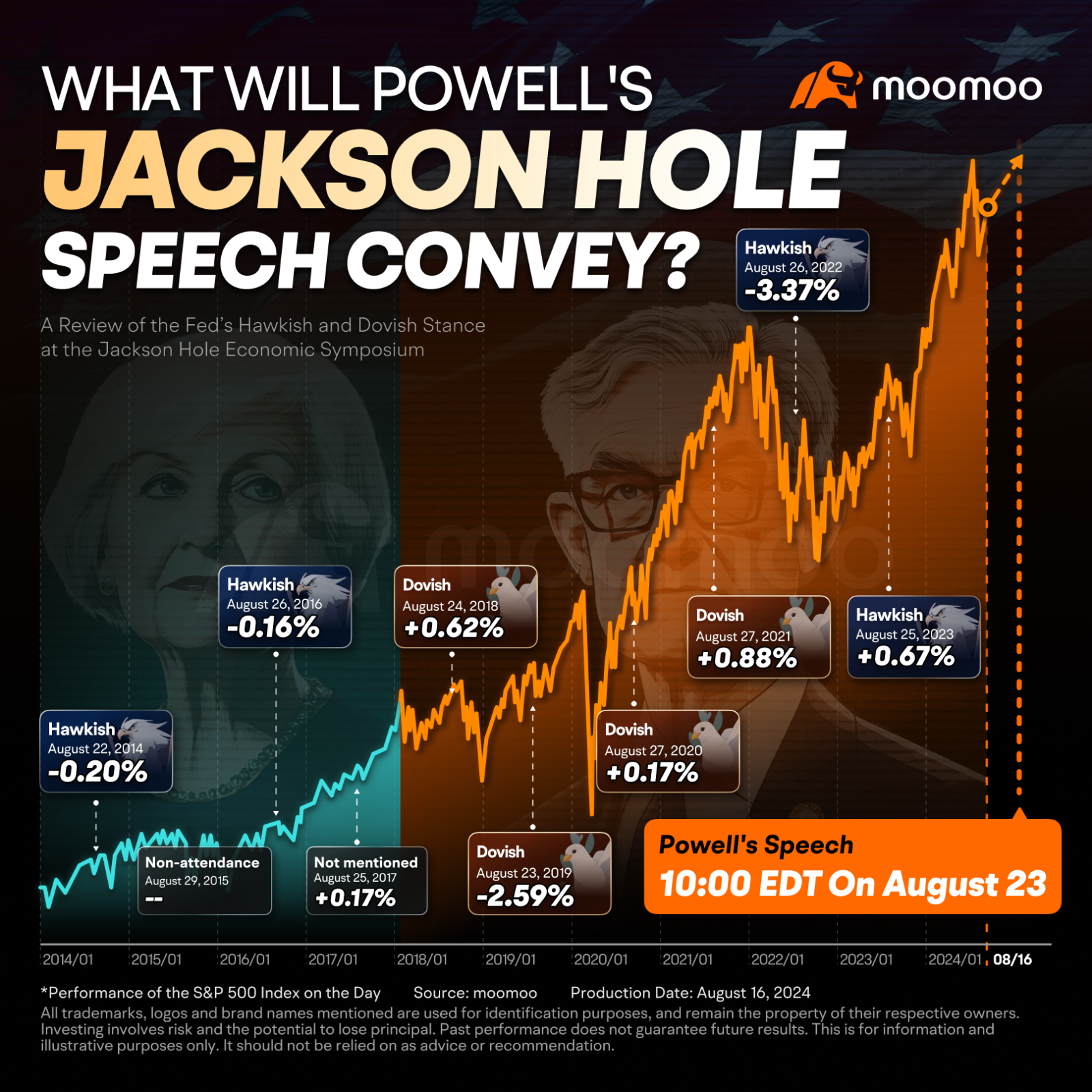

■ Powell's Jackson Hole address frequently triggers stock market swings

It should be noted that in recent years, the U.S. stock market has often experienced significant fluctuations around the time of Powell's speech at the Jackson Hole Annual Meeting.

For instance, in 2022, Powell's speech sent U.S. stocks tumbling, with a "painful" narrative causing the major U.S. stock indices to plunge by 3%-4% within just nine minutes on that day. In 2023, the market saw significant waves as well, though the turbulence occurred the day before Powell's speech on Thursday, with the Dow Jones recording its biggest point drop in five months and the Nasdaq falling nearly 2%.

However, the good news is that historically, aside from the 2022 Jackson Hole event that triggered a stock market crash, this annual central banking event has generally been beneficial for U.S. stocks. Since 1998, the median gain for the S&P 500 index in the week following the Fed Chairman's speech at Jackson Hole has been 0.6%, with an increase seen in 70% of the years.

■ Fed's major focus shifts from inflation to the job market

The July consumer inflation data, released earlier Wednesday, was seen by most economists as good enough to spur a September rate cut.

“The headline CPI came in below 3% for the first time since March of 2021. Chair Powell should take a victory lap in Jackson Hole and try to talk about rate cuts in September,” said Scott Helfstein, head of investment strategy at Global X, in a note.

“This is now a labor data-first Fed, not an inflation data-first Fed, and the incoming labor data will determine how aggressively the Fed pulls forward rate cuts,” Krishna Guha, vice chairman of Evercore ISI, said in a note to clients.

Stocks have recovered a significant portion of the steep losses that began in August and are still notably up for the year. Despite the initial August downturn, partially due to a disappointing July jobs report and a rapid unwinding of the popular carry trade involving the Japanese yen, stock market investors seem optimistic about the economy's ongoing growth. However, the fed-funds futures market has factored in a substantial sequence of rate reductions, suggesting concerns that the Fed may need to take bold action in response to a sharp weakening of the economy.

■ How much will the Federal Reserve cut interest rates in September?

Powell will set the tone for coming monetary easing by leaning into the need to be “proactive” rather than “reactive” with rate cuts, said Guha.

Although expectations are high for the Fed to cut interest rates at their upcoming meeting on September 17-18, opinions vary on the extent of the rate cut. The majority of economists anticipate a reduction of a quarter percentage point in interest rates, but some, including analysts at Citigroup Inc. and JPMorgan Chase & Co., foresee a more assertive half-percentage point cut.

The actual size of the move will be determined by the August jobs data that comes a week later on Sept. 6, economists said.

In Guha's analysis, he detailed his expectations for the Federal Reserve's actions in response to the August employment figures.

Guha's primary expectation is that if the August job report shows improvement over the previous month, the Fed will implement a 25-basis point rate reduction in each of the year's three remaining meetings and continue with similar "as needed" cuts into the first quarter of the following year.

However, if the August jobs report confirms a continuation of the recent weakening trend, Guha believes the Fed is likely to enact two aggressive 50 basis point reductions in September and November.

Guha suggests that only a particularly strong employment report would lead the Fed to limit itself to just two rate cuts of 25 basis points this year.

Two former Fed officials said Wednesday that, based on what they know today, the Fed was likely to cut the Fed funds rate by 25 basis points at the September meeting.

“I am not in the camp of thinking that a larger cut in September is where they will land,” said former Kansas City Fed President Esther George.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

102429238 : can only wait

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Malik ritduan : ok

104327919 : good

XPDHugo :

igmm :

HYGWE : 25 25 25....

MelloJoe : Awesome

101775147 AL alfijai : The Malaysian Open

102643351 : Good