What to Know Ahead of Broadcom's Earnings Report

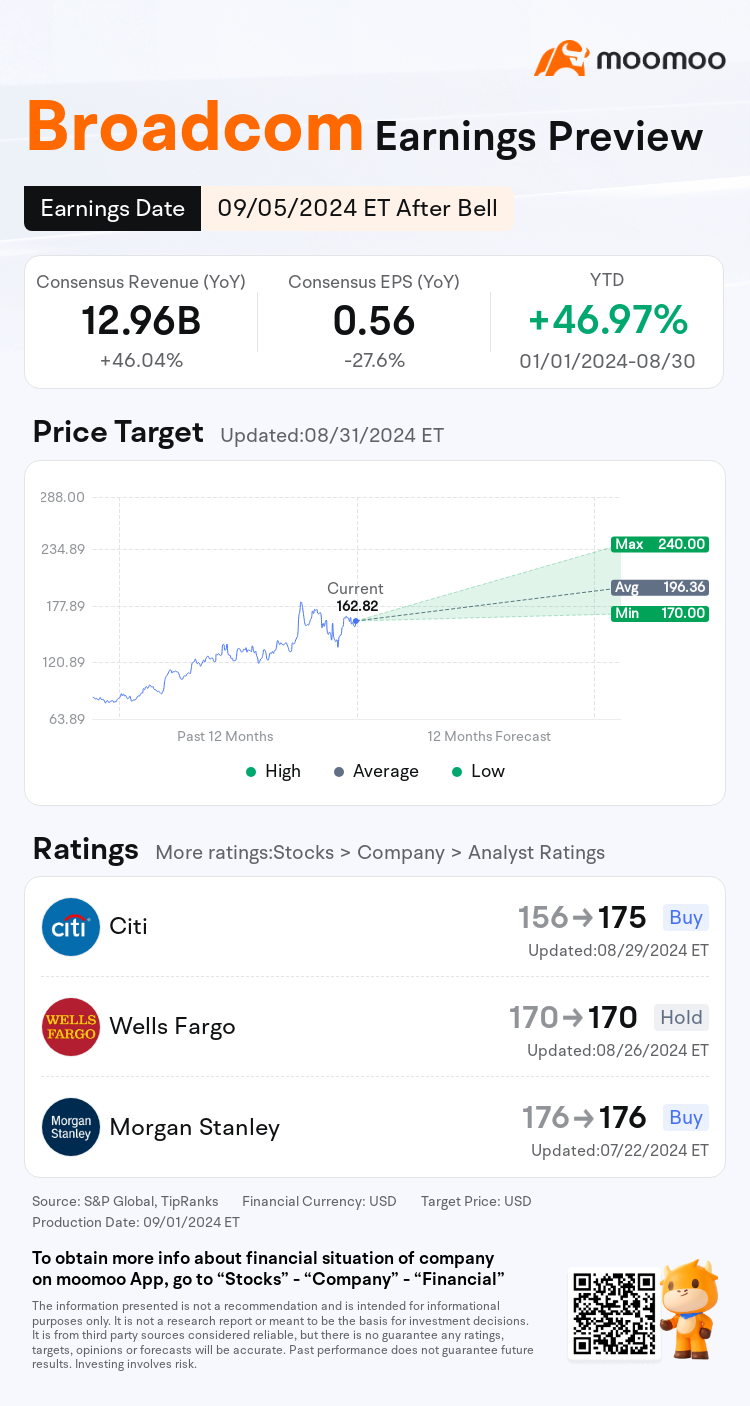

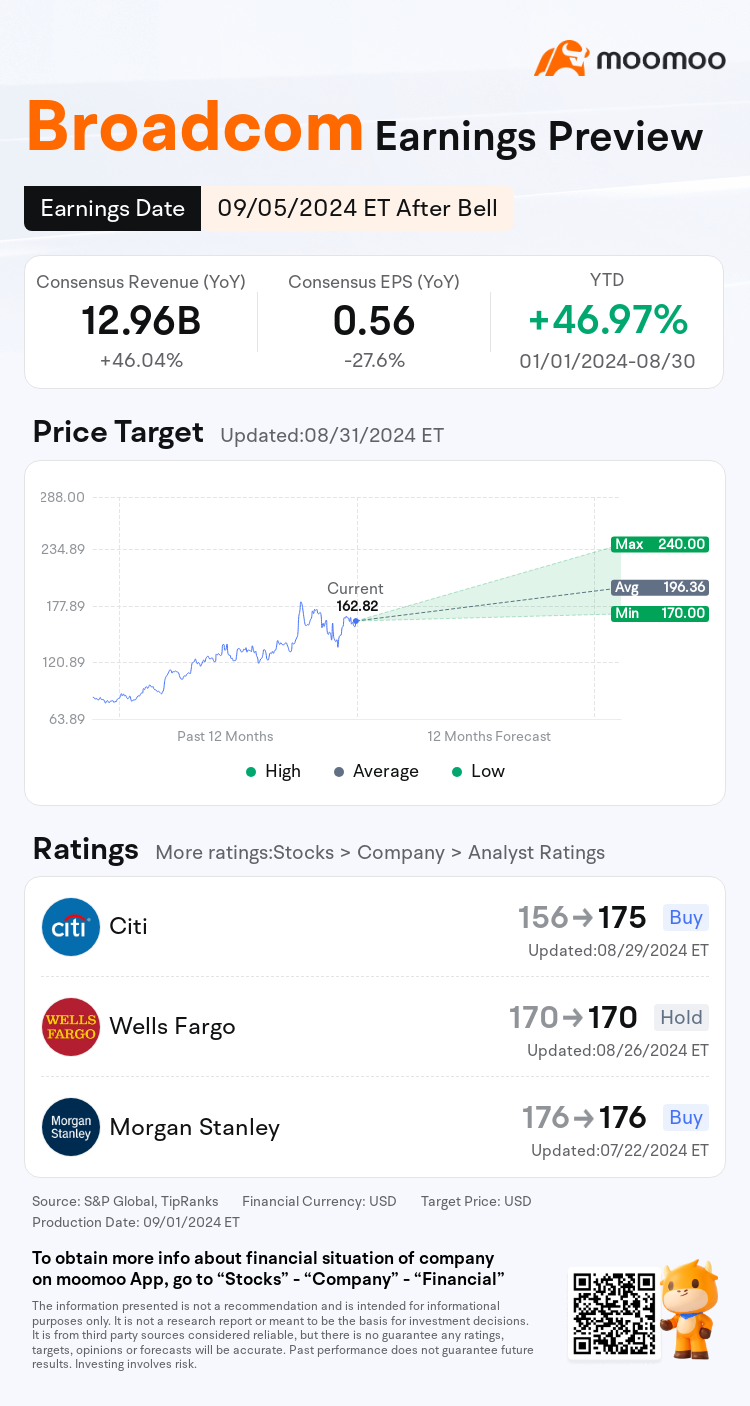

Investors are closely watching $Broadcom (AVGO.US)$ as it prepares to report third-quarter 2024 results after the market closes on Thursday. Analysts project a 46% revenue increase year-over-year, despite a decline in net income. Artificial intelligence is expected to be a key focus, with investors looking for growth in AI sales, updates on the company's full-year AI revenue outlook, and potential news about OpenAI becoming a new AI chip customer.

Here Are Key Expectations to Watch:

Analysts expect revenue to reach $12.96 billion, up from $8.88 billion a year ago. Net income is projected to decline to $2.94 billion from $3.3 billion last year, with diluted earnings per share (EPS) also expected to decrease. This summer, the company executed a 10-for-1 stock split.

Broadcom's stock has surged 47% in 2024, outperforming the $PHLX Semiconductor Index (.SOX.US)$'s 23.5% gain. This growth is driven by strong quarterly results and rising demand for its custom AI chips. In June, Broadcom projected over $11 billion in AI chip revenue for the year, but recent quarterly results suggest this figure could be even higher. Investors might consider buying shares ahead of Broadcom's earnings report on Thursday.

Investor Optimism High Ahead of Q3 Results

Broadcom's revenue is projected to grow 46% year-over-year, largely due to its November 2023 acquisition of VMware. The company has surpassed Wall Street's earnings expectations for the past four quarters and raised its fiscal 2024 revenue forecast to $51 billion, up from $50 billion, driven by strong AI chip demand. Broadcom's custom AI processors are being deployed by major tech companies, and its networking business is experiencing rapid growth due to increased demand for ethernet switches in data centers. AI revenue soared 280% year-over-year last quarter, indicating sustainable long-term growth potential.

Broadcom derives 58% of its revenue from semiconductor sales, generating $7.2 billion in fiscal Q2, which translates to an annual run rate of nearly $29 billion. Notably, $3.1 billion, or 43%, of these sales came from AI chips.

With a $150 billion revenue opportunity on the horizon, Broadcom's semiconductor revenue is poised for significant long-term growth. The company may raise its full-year guidance again on Sept. 5, driven by an expanding customer base for custom AI processors and increased production for a third customer this year. A strong earnings report and potential guidance boost could propel Broadcom's stock, making it a compelling buy ahead of its results. Given its valuation and growth prospects, holding Broadcom stock for the long term appears prudent.

Broadcom Secures Key Wins With OpenAI, Google & Meta

Broadcom is advancing its AI strategy with significant wins in multi-generational AI ASIC programs, notably with OpenAI and a fifth major customer, aiming for a 2026 ramp-up. The company's cutting-edge 2nm/3nm technology and robust partnerships with Google and Meta are pivotal in its bid for a $150 billion AI market opportunity.

JPMorgan's Harlan Sur highlights Broadcom's recent victories in securing OpenAI's first and second-generation AI ASIC programs, positioning it as OpenAI's fourth major AI ASIC partner. Additionally, Broadcom has gained a fifth major AI ASIC customer, both set to ramp up by 2026, reinforcing its leadership in the AI space.

• Advanced Chip Design: A Competitive Edge

Broadcom's advanced chip technology, particularly its 2nm/3nm AI ASIC reference platform with industry-first 3D SoIC (chip stacking) initiatives, has been instrumental in these wins. This platform maximizes transistor density and performance while reducing power consumption.

• AI Revenue Pipeline with Google and Meta

Broadcom's AI momentum extends beyond OpenAI. The company is ramping up its AI initiatives with $Alphabet-A (GOOGL.US)$ and $Meta Platforms (META.US)$. Sur notes that Broadcom is set to ramp up Google's next-gen 3nm TPU AI processor by year-end, projecting revenues of over $8 billion this year and $10 billion next year. Meta is also expected to become a multi-billion dollar customer, significantly contributing to Broadcom's AI revenue growth.

• $150 Billion AI Opportunity

Sur describes a “$150B+ AI semiconductor opportunity over the next five years” for Broadcom, driven by strong demand for custom chip designs from large cloud companies and OEMs. With the AI market expected to grow at a 30-40% annual rate, Broadcom's recent wins with OpenAI and the fifth major customer are poised to be key revenue drivers.

Broadcom's strategic AI partnerships and technological advancements position it for substantial growth in the AI semiconductor market. With a strong pipeline and optimistic revenue outlook, Broadcom remains a key player to watch in the AI space.

Analysts' Take

• Harlan Sur of JPMorgan projects that Broadcom's cumulative AI revenue opportunity over the next four to five years could reach an impressive $150 billion, potentially driving the company's semiconductor revenue to grow at an annual rate of 30% to 40%.

• Oppenheimer's Rick Schafer anticipates Broadcom's Q3 results and Q4 outlook to surpass expectations, driven by gains in AI and VMware. Following the acquisition of VMware last year, AI contributions are projected to exceed $11 billion in 2023, up from $7.5 billion at the start of the year, with a 65/35 split between ASIC and networking.

• Bank of America analyst Vivek Arya noted that if volatility persists in the semiconductor industry, Broadcom is likely to outperform.

Volatility could persist through NVDA earnings and then into Sep, historically the worst month for SOX, down 70% of the time. US elections and ongoing geopolitical tensions add an extra layer of uncertainty."

• TD Cowen identified Broadcom as a key beneficiary of increased AI spending. The firm noted ongoing strong demand for generative AI and highlighted Broadcom's recent full-year AI outlook increase, with AI-related revenue expected to reach $11 billion in 2024.

• Baron Opportunity Fund highlighted Broadcom in its Q2 2024 investor letter, noting the company's strong earnings driven by AI semiconductors and its VMware business. Broadcom increased its AI revenue outlook to $11 billion for the year, citing strength in hyperscale custom compute and networking chips. The company plays a critical role in scaling AI training factories and designs custom accelerators for major AI companies like Google and Meta. VMware is also expected to surpass growth expectations while improving margins through a shift to subscriptions. These factors have led to a positive re-rating of Broadcom's growth profile.

Source: Investopedia, The Motley Fool, Benzinga, Yahoo Finance, Dow Jones

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

103740441 : hi

102181510 : Good

102708725 : good

104327919 : ok

Alice Lim choo :

Ramli : good