What You Need to Know Ahead of U.S. August PCE Price Index

The Bureau of Economic Analysis will release the August Personal Consumption Expenditure and the price index at 8:30 ET on Friday.

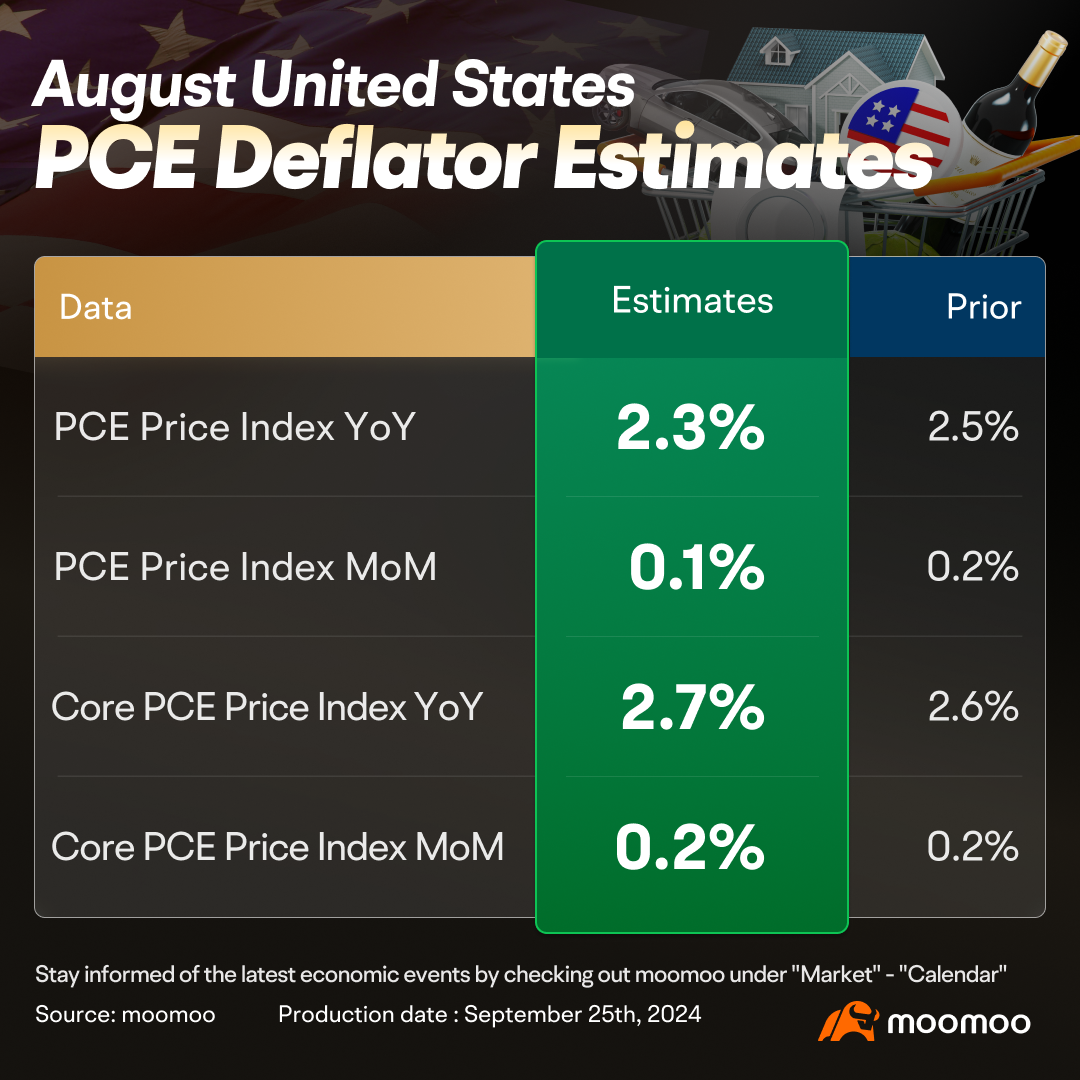

Economists polled by Bloomberg expect core PCE inflation to remain at +0.2% in August. The year-over-year figure is expected to edge up to +2.7%. The headline PCE inflation growth rate will likely be +0.1%, and will likely decelerate to +2.3% on a year-over-year basis, down from 2.5% in July.

▶ House prices reach new highs, posing challenges to core inflation

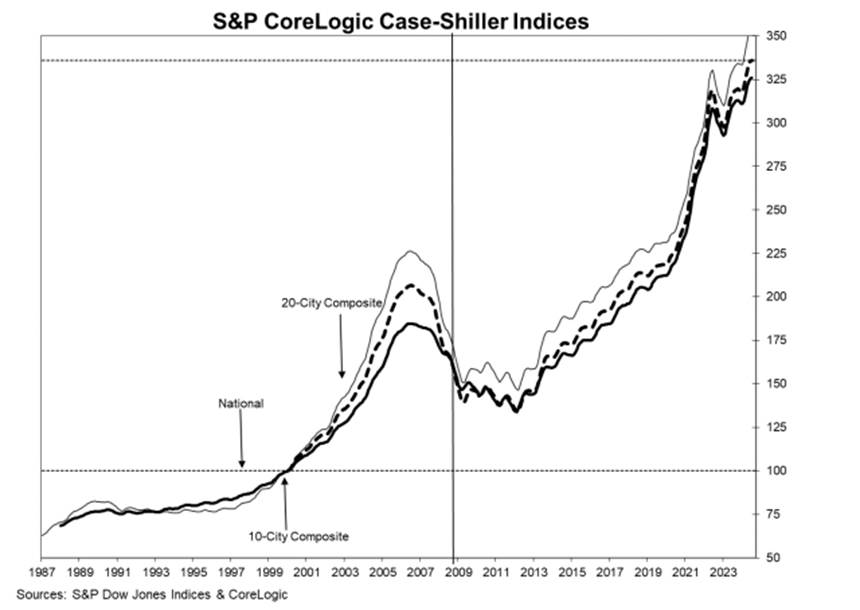

The latest S&P CoreLogic Case-Shiller Indices released on September 24thindicated the measure of U.S. home prices reached a new all-time high. The report showed a 5.0% annual gain for July, and the 10-City Composite saw an annual increase of 6.8%.

The continuously rising cost of housing has added difficulty to the Federal Reserve's final stretch in controlling inflation.

Federal Reserve Governor Michelle Bowman expressed that although there have been recent improvements, inflation remains a major issue. " While it has not been my baseline outlook, I cannot rule out the risks that progress on inflation could continue to stall," Bowman commented.

▶ Travel prices decreased in August

U.S. Travel Association's Travel Price Index showed the cost of travel away from home alleviated in August.

When comparing prices from August 2024 to August 2023, U.S. airfares have decreased by 1.3%. Compared to pre-pandemic levels, the decrease is more significant at 6.5%. Rental car prices are also better now than they were a year ago, showing a decline of 8.4% year-over-year. Additionally, prices for lodging away from home, including hotels and motels in U.S. cities, have decreased. Compared to August 2023, hotel prices have seen only a slight increase, rising by 1.8%. Falling travel costs are expected to further ease core inflation.

▶ Are consumers choosing to spend, or are they compelled to?

Personal income and outlays data will also be released on Friday.

Before August, spending growth exceeded income for several consecutive months, causing the savings rate to fall to 2.9% in July. This is the second time since 2008 that the savings rate has fallen below 3.0%, indicating that consumers are forced to give up savings in order to meet the increase in necessary expenses.

As for August, the retail sales report earlier showed widespread declines across seven of the 13 categories, with significant drops in discretionary sectors such as food & beverage, clothing, and electronics. Nevertheless, a surge in online shopping led to a 0.3% increase in control group sales, still suggesting a strong performance in personal spending this month.

Economists predict that personal spending increased by 0.3% in August, supported by a 0.4% rise in personal income.

▶ What's the implication for the Fed?

Last Wednesday's interest rate cut and the statement from the FOMC meeting show that the importance of inflation as a consideration in monetary policy has decreased. Chair Powell summarized last week: "It’s a process of recalibrating our policy stance away from where we had it a year ago when inflation was high and unemployment low to a place that’s more appropriate, given where we are now and where we expect to be, and that process will take place over time."

However, the dynamics of the PCE still have some reference value for the rate cuts in November and December of the next few years. If inflation can continue to decline, it means that the Fed's decisions have not triggered reflation, allowing Powell to continue rate cuts with greater assurance to better balance inflation, economic growth, and employment.

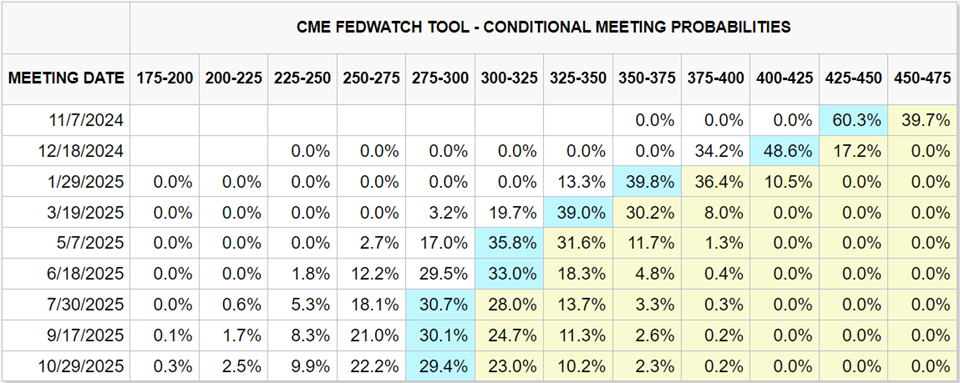

The CME FedWatch tool indicates that there is a 60.3% chance that the Federal Reserve will again cut rates by 50 basis points in November. However, there are still more than 40 days left until the next FOMC meeting. The nonfarm payroll data for September and October, along with the CPI for September, will add further uncertainties. As the election approaches, the Federal Reserve's monetary policy will become increasingly sensitive. Therefore, before the quiet period begins, Fed officials may take the opportunity to convey more information through public speeches.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Paul Bin Anthony : https://www.moomoo.com/community/feed/113202387353605?share_code=01obYt

steady Pom pipi :

103356238jenny tan :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

70727465 : I guess our bear market gonna start only after elections

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

向往成功 70727465 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)