US July CPI is coming today: Is inflation coming off its peak?

CPI is reported at 8:30 a.m E.T. Wednesday and is expected to show that inflation has finally peaked. Investors are also closely watching the report to see how aggressively the Federal Reserve might raise interest rates to rein in rising prices.

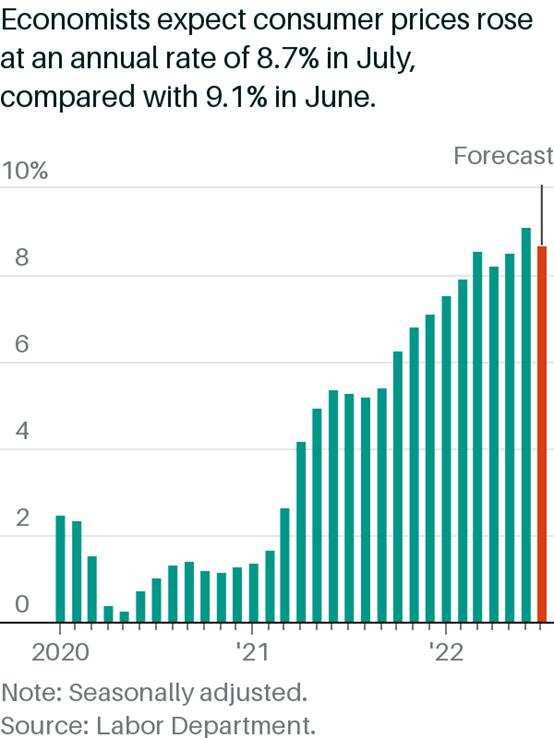

CPI Inflation Rate Forecast

Economists expect July's consumer price index rose 0.2% quarter-over-quarter, down from 1.3% in June, according to Dow Jones. Year-over-year, the pace of consumer inflation in July is expected to fall to 8.7%, down from June's 9.1%.

However, core inflation, which excludes food and energy prices, isn't expected to show much moderation. The core inflation rate is expected to tick back up to 6.1% from 5.9%, with rising shelter costs a prime contributor.

Inflation Expectations Falling

The report comes as both consumer and market expectations for inflation are falling. A survey from the New York Federal Reserve showed that consumers expected inflation to reach 6.2% over the next year and 3.2% annually over the next three years. That is a big decline from the respective 6.8% and 3.6% in June.

Fed's Focus Shifts Back to Core Inflation

As oil prices fell, Powell once again focused on core inflation. "Core inflation is a better indicator of future inflation," Powell said at a news conference on July 27.

According to the Labor Department, non-energy services account for 57% of consumers' budgets, with housing and health care spending at the top of the list. Inflation in these categories reached a 30-year high of 5.5% in June.

The Next Fed Rate Hike: 50 or 75 Basis Points?

As of Tuesday afternoon, traders were already pricing in a roughly 2 in 3 chance of another three-quarter point rate hike next month, according to CME data.

The decision to hike 75 basis points at each of the past two Fed meetings "was driven by rising inflation expectations, which have since moved down decisively," wrote Jefferies chief financial economist Aneta Markowska.

The decision to hike 75 basis points at each of the past two Fed meetings "was driven by rising inflation expectations, which have since moved down decisively," wrote Jefferies chief financial economist Aneta Markowska.

What Do Economists Think?

Strategas Head of Fixed Income Research Tom Tzitzouris said the U.S. has now "very likely" hit peak inflation in the headline CPI figure.

"Core goods inflation should also subside in the coming months given the overwhelming evidence of easing supply chain pressures," wrote $Jefferies Financial(JEF.US$'s chief financial economist Aneta Markowska. But she expects core services inflation to "remain sticky, supported by the tightness in housing and labor markets."

"The first sign of meaningful deceleration in headline inflation will be helpful to the Fed in its mission to show a strong commitment to bringing inflation down," $Morgan Stanley(MS.US$ economists wrote in a note previewing the CPI release last week. "However, Fed officials will not have the luxury to focus on lower headline inflation given that underlying core inflation trends remain strong."

"The first sign of meaningful deceleration in headline inflation will be helpful to the Fed in its mission to show a strong commitment to bringing inflation down," $Morgan Stanley(MS.US$ economists wrote in a note previewing the CPI release last week. "However, Fed officials will not have the luxury to focus on lower headline inflation given that underlying core inflation trends remain strong."

"If Fed chatter points to headline CPI receding and doesn't focus as much on core," Morgan Stanley's chief U.S. economist Ellen Zentner added in a memo last Friday, "then 50bp should still be seen as the baseline, and I would expect market pricing for 75bp to recede."

So mooers, What do you think? What is your take on inflation? Leave your comments below:

Source: Investor's Business Daily, Labor Department, Bloomberg, Dow Jones, CNBC

Disclaimer: The content should not be relied on as advice or recommendation.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

71357620 : no

71357620 : it will be worse just watch and the markets will tank

jkrash : it will be 8.7 or lower, the market will moon

High Profit Low Loss : It’s good that Fed shows strong commitment to bringing inflation down. Looking forward to market rally.

Imranm20 : I believe inflation will slightly be higher than the forecast of 8.7%, forcing FED to go with 75bps hike in next meeting.

102405503 No limit : non event

FirstStrike Veteran : Michigan predictions come out at 10 EST today. I believe that since we don't have a FED meeting this days could help push the market higher or lower depending on if it beats expectations or not.