Options Market Statistics: AMC Shares Crater as Investors Brace for Stock Conversion, Options Pop

News Highlights

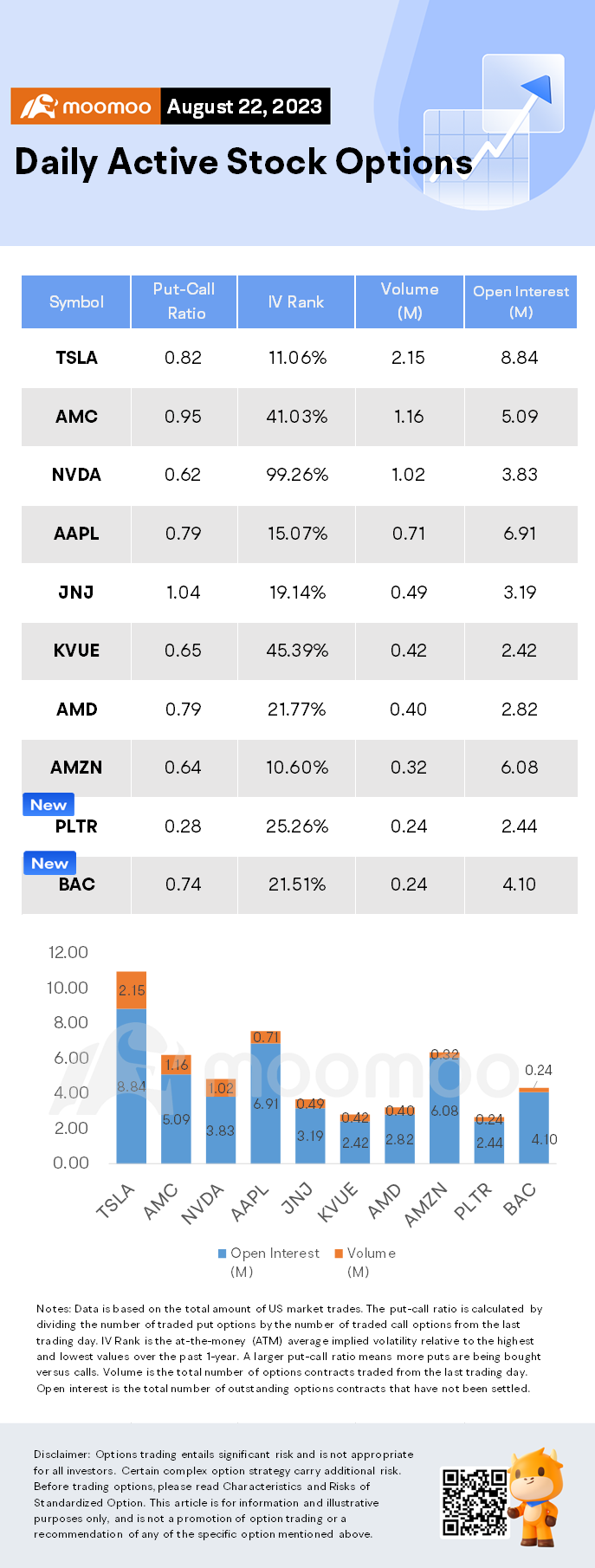

$AMC Entertainment (AMC.US)$ shares fell by 18.27%, closing at $2.55. Its options trading volume is 1.16 million. Call contracts account for 51.3% of the whole trading volume. The most traded calls are contracts of $4 strike price that expire on August 25th. The total volume reaches 54,997 with an open interest of 110,008. The most traded puts are contracts of a $4 strike price that expires on August 25th; the volume is 70,866 contracts with an open interest of 228,569.

AMC Entertainment shares plummeted nearly 20% on Tuesday, slipping to a new 52-week low of $2.55 per share, as investors brace for a stock conversion later this week.

On Friday, the movie theater chain's preferred equity units, dubbed APE shares, are set to be transformed into common stock just one year after they began trading on the New York Stock Exchange. These preferred equity units are a workaround, of sorts, and free AMC up to sell additional units of stock after investors who feared dilution rejected the company's efforts to issue additional stock last year. AMC raised billions during the Covid pandemic selling new stock, which aided the company in paying off its debts and staved off bankruptcy during a time when movie theaters were closed or had limited product to screen to audiences.

AMC also is planning a 10-to-1 reverse stock split of its common stock on Thursday.

$Bank of America (BAC.US)$ shares fell by 2.44%, closing at $28.44. Its options trading volume is 0.24 million. Call contracts account for 57.3% of the whole trading volume. The most traded calls are contracts of $29 strike price that expire on August 25th. The total volume reaches 10,796 with an open interest of 5,761. The most traded puts are contracts of a $25 strike price that expires on January 19th 2024; the volume is 10,209 contracts with an open interest of 60,555.

Bank of America and $Wells Fargo & Co (WFC.US)$ shares are trading lower Tuesday. Shares of several bank and financial service stocks are falling after S&P Global Ratings downgraded several regional banks.

Downgrades of multiple regional banks by S&P Global Ratings could signal challenges within the broader banking sector. If several banks in the same sector face credit rating downgrades, it might suggest a sector-wide issue, such as financial instability, economic uncertainty or credit quality concerns.

This sentiment could lead investors to worry about the health of the sector as a whole, including larger banks like Bank of America and Wells Fargo.

$Tesla (TSLA.US)$ shares rose by 0.83%, closing at $233.19. Its options trading volume is 2.15 million. Call contracts account for 55.0% of the whole trading volume. The most traded calls are contracts of $240 strike price that expire on August 25th. The total volume reaches 153,893 with an open interest of 27,488. The most traded puts are contracts of a $230 strike price that expires on August 25th; the volume is 101,506 contracts with an open interest of 8,289.

One of the most anticipated vehicle launches of all time is nearing its launch date: the Cybertruck electric pickup truck from Tesla. The launch and subsequent production and deliveries of the Cybertruck are expected to be a major catalyst for Tesla going forward.

Unusual Stock Options Activity

There were noteworthy activities in $AMC Entertainment (AMC.US)$ where multiple options have topped volume to open interest ranking. The highest volume over open interest ratio reaches 80.86x with 44,713 contracts.

Daily Active Index & Sector ETF Options

Source: Benzinga, Dow Jones, CNBC

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please readCharacteristics and Risks of Standardized Option.This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Source: Benzinga, WSJ

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

GoliathSack : put amc?