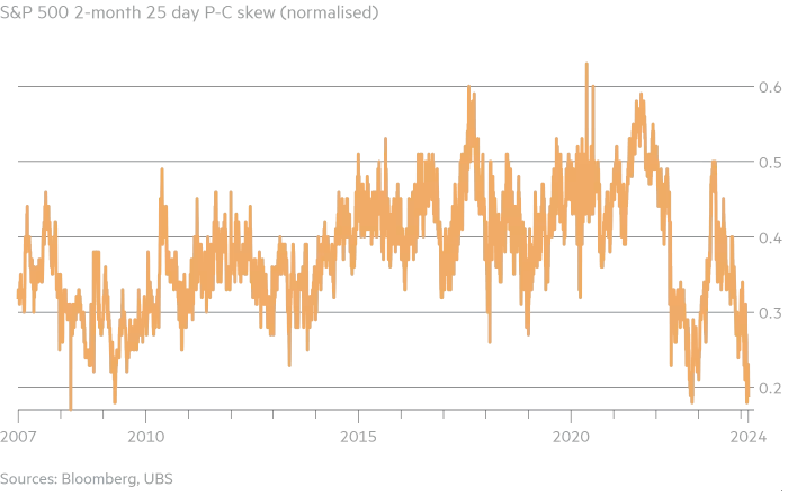

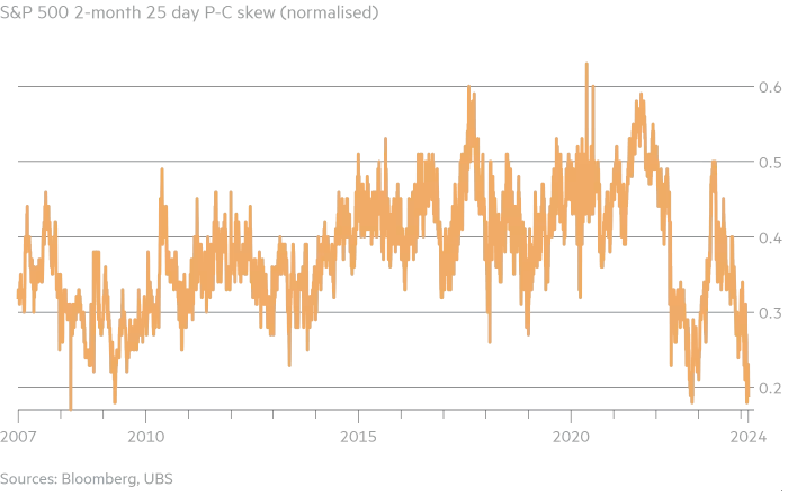

Stock Market Rally Boosts Investor Sentiment as US Options Skew Drops to Record Low

The latest readings from a key stock market sentiment indicator have reached a level not seen since 2008, signaling that options traders are now more focused on capitalizing on the continuing surge in stock indices rather than bracing for a downturn.

This shift comes in the wake of the $S&P 500 Index (.SPX.US)$'s remarkable ascent of nearly 25% since early November, defying expectations that high-interest rates would precipitate a recession. Traders are increasingly gravitating towards S&P 500 index options that yield profits if the market’s upward trajectory persists. This has resulted in the so-called skew—a measure comparing the implied volatility of puts and calls—for both the S&P 500 and the $Nasdaq Composite Index (.IXIC.US)$ dropping to its lowest in 16 years, as per Bloomberg data analyzed by UBS.

A low implied volatility also signals that the market's expectation of market fluctuation is hovering at a lower level.

Demand for downside protection often leads to higher skewness levels in the options market, where the implied volatility (and thus the price) of put options is higher relative to call options. The skewness becomes particularly pronounced in anticipation of "black swan" events—unpredictable or rare incidents with severe impacts—because investors are willing to pay a premium for protection against such extreme market movements, thus elevating the cost of puts over calls as a safeguard against potential financial turmoil.

Gerry Fowler, an equity and derivatives strategist at UBS, highlighted the Fear of Missing Out (FOMO) driving the market: "With such a potent rally, many are ensuring they capture the upside, unconcerned by minor pullbacks, hence the lack of interest in purchasing puts."

This phenomenon of a "flat skew"—where puts and calls are similarly priced—is atypical during vigorous market rallies, where protection against potential declines is commonly sought. "Market peaks usually prompt a cautious shift towards puts over calls," observed Rocky Fishman, a derivatives analyst at Asym 500, "but this has not been uniformly the case, as seen during the dotcom bubble."

The current options market pricing reflects a strong investor belief in a potential "soft landing" for the US economy, avoiding a recession. According to Fishman, a flat skew at the peak of a rally could indicate either concern over valuations or optimism for further gains.

Charlie McElligott, managing director of cross-asset strategy at Nomura, noted the prevailing bullish sentiment, suggesting that the fear of missing out on further gains now outweighs concerns of a market correction. This enthusiasm is evident in the growing popularity of speculative assets, with bullish options for US "meme stocks" like Robinhood, Carvana, and Coinbase seeing a surge in demand. This has led to an unusual scenario where the implied volatility of calls surpasses that of puts for these securities, including Nvidia—a reversal of the typical relationship.

Source: FT.com, UBS

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment