US June CPI Preview: The Upcoming Inflation Data May Increase the Likelihood of a Rate Cut in September

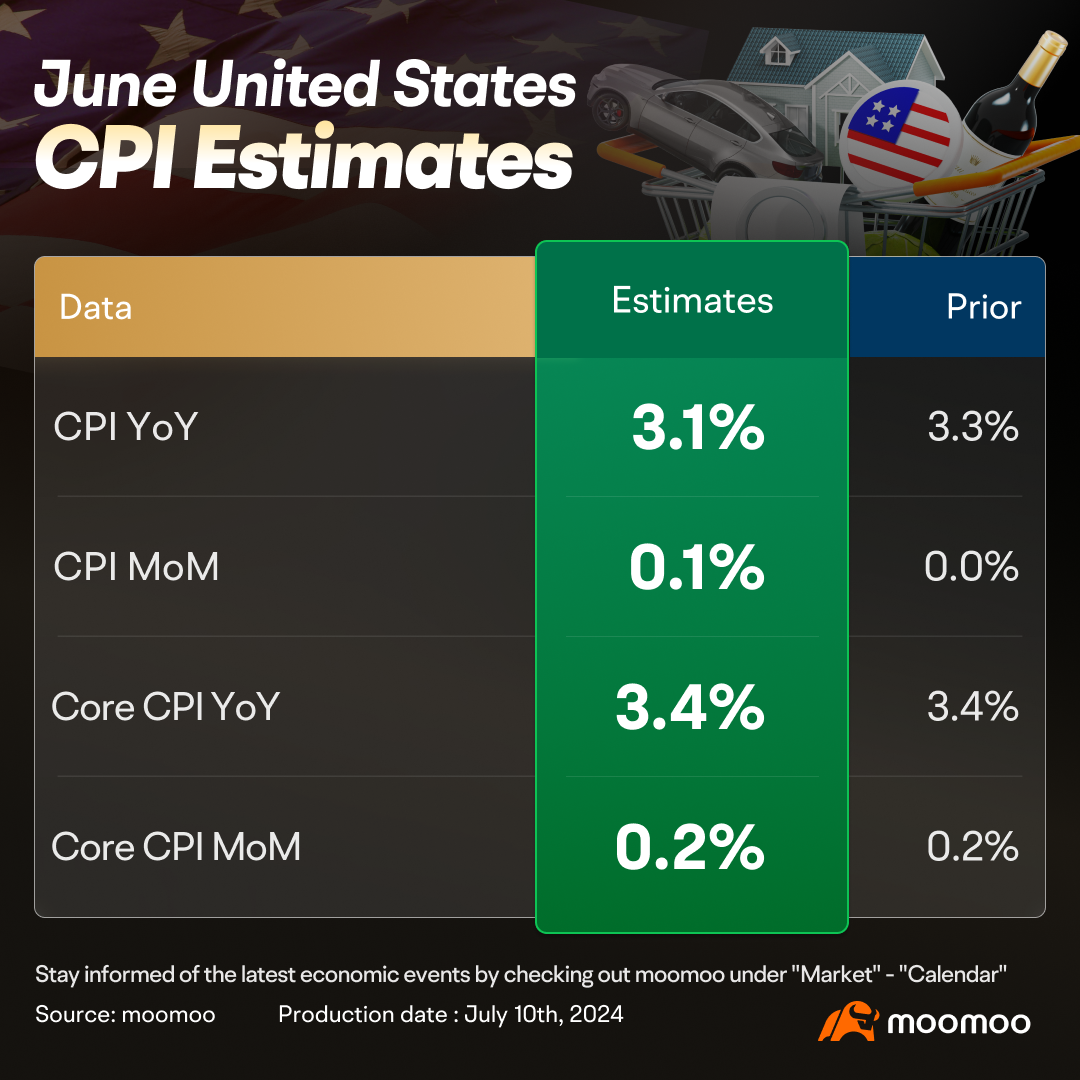

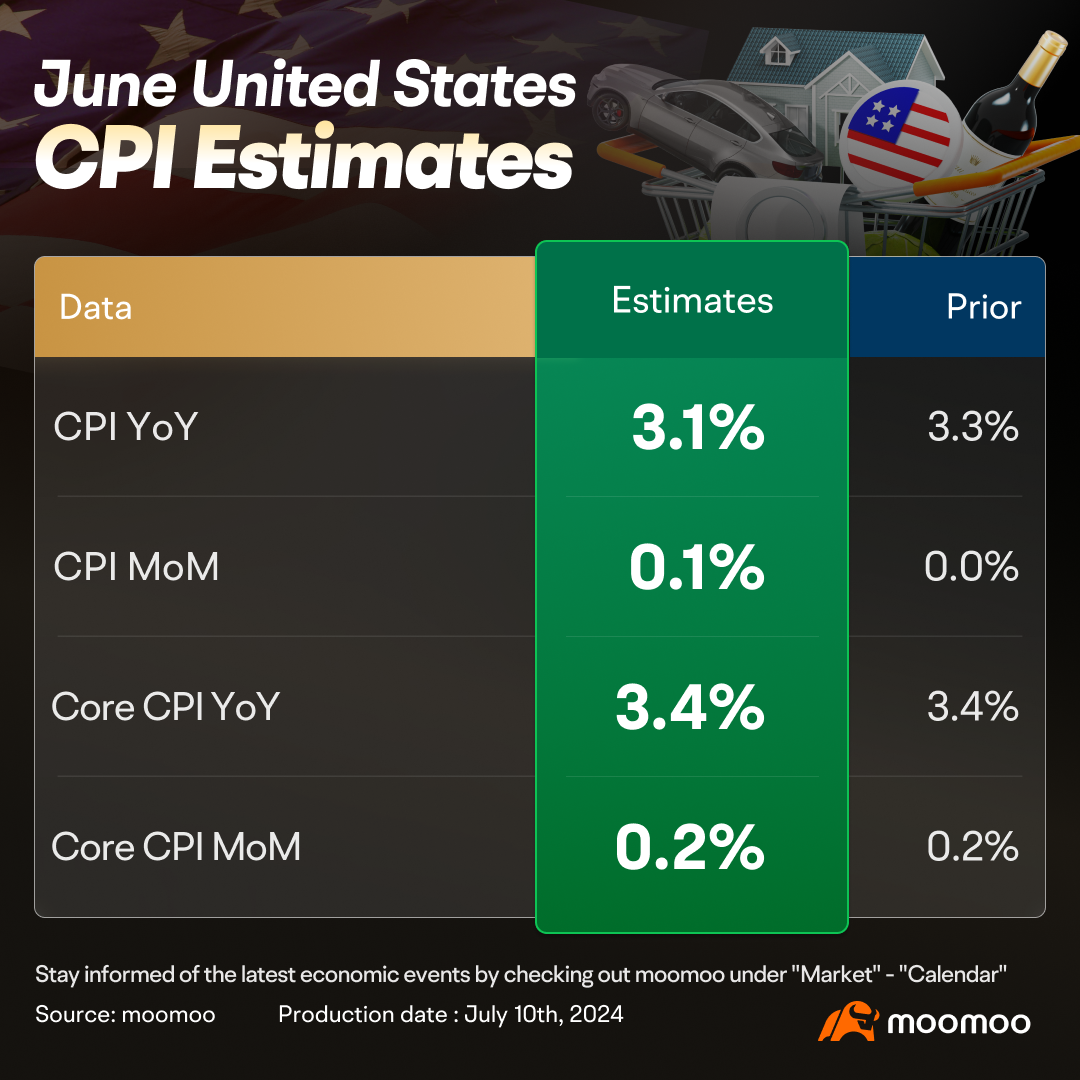

On July 11, the U.S. Bureau of Labor Statistics will release CPI data for June at 8:30 a.m. ET. The headline CPI is anticipated to show a modest increase of 0.1%, primarily due to a significant seasonally adjusted decrease in gasoline prices. The monthly core CPI is predicted to maintain a steady growth of 0.2%. Year-over-year, the headline CPI is projected to drop to 3.1%, down from May's 3.3%, with sectors such as used cars and recreation contributing to a slowing inflation rate, while the core CPI is expected to remain unchanged at 3.4%.

■ Average oil prices fell slightly in June

In June, the average price for crude oil in the spot market stands at $81.20, experiencing a slight decrease from the previous month's $81.44 and an increase from the $73.26 price point of a year earlier. This represents a modest month-over-month drop of 0.29% and a year-over-year rise of 10.84%. Lower oil prices should translate to a decline in energy prices during the month.

■ Food prices were steady last month

The FAO Food Price Index was recorded at 120.6 points in June 2024, holding steady from its revised value in May. The number resulted from a balance between rising prices in the vegetable oil, sugar, and dairy sectors, which offset a decline in cereal prices, while the meat price index remained nearly the same. Although prices have solidified after three straight months of increases, the food price index was still 2.1 percent below its level from the same period in the previous year, and 24.8 percent beneath its March 2022 peak of 160.3 points.

■ New and used car prices continued to fall

Wholesale used-vehicle prices were down in June compared to May. The Manheim Used Vehicle Value Index (MUVVI) fell to 196.1, a decline of 8.9% from a year ago. The value declined by 0.6% month over month for the second time in a row.

Jeremy Robb, the Senior Director of Economic and Industry Insights at Cox Automotive, observed, "Wholesale value declines have been stronger than we normally see for much of the last two months."

Seasonally adjusted electric vehicle (EV) values for June 2024 were down 16.6% compared to June 2023, while non-EVs were down 9.5% for the same period. Compared to May, seasonally adjusted EV values continued to decline more than the market overall, falling by 6.5% in June, while non-EVs declined only 0.3% over the same period.

■ Rent growth remained in negative territory company to one year ago

According to Apartment List, the national median rent experienced a 0.4% increase in June, reaching $1,411, although the growth rate has decelerated a bit this month. Normally, this period marks a time when rent growth tends to pick up due to the high season for relocation. However, this year's seasonal rent hikes have been comparatively subdued, leading to rents that are, on average, marginally lower than they were at the same time last year. The year-over-year rent growth is currently at -0.7 percent, and it has been negative since the previous summer.

On the supply side of the housing market, the national vacancy index is slightly above the norm, presently at 6.7 percent. Following an unprecedented tightening in 2021, the occupancy rates for multifamily housing have been gradually and steadily easing for more than two years.

■ Will June's CPI fuel expectations for a rate cut in September?

Following the release of the nonfarm payroll data last Friday, the swap market increased its bets on the Federal Reserve initiating its first rate cut of the year in September. The CME Group's FedWatch tool indicates that the swap market anticipates a 70.0% probability of the Fed cutting rates by 25 basis points in September.

Analysts believe that this week's CPI report is expected to serve as an additional confidence booster.

Andrew Tyler, the head of the US Market Intelligence team at JPMorgan Chase, said: "The price of at-the-money straddle options expiring on Thursday indicates that the options market is currently betting on a fluctuation of up to 0.9% in the S&P 500 index by Thursday. As traders bet on a slowdown in inflation that will prompt the Federal Reserve to cut interest rates twice within the year, the report could trigger unusual market volatility."

"Several former Federal Reserve governors believe that September is the appropriate time for a rate cut. With this in mind, we remain tactically bullish." Tyler noted.

Related Article: Rate Cut Expectations Rekindled, Pushing the Market to New Highs. What Other Catalysts Could Trigger a Rate Cut?

Stay ahead of the market with our Economic Calendar feature! Get valuable insights on the US CPI outlook, including historical trends and preview data. Click to try!>

Related Article: Rate Cut Expectations Rekindled, Pushing the Market to New Highs. What Other Catalysts Could Trigger a Rate Cut?

Stay ahead of the market with our Economic Calendar feature! Get valuable insights on the US CPI outlook, including historical trends and preview data. Click to try!>

免责声明:此内容由Moomoo Technologies Inc.提供,仅用于信息交流和教育目的。

更多信息

评论

登录发表评论

YawningKitty_x_x :![旺柴 [旺柴]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![旺柴 [旺柴]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![旺柴 [旺柴]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Gilley : 消费者价格指数的估计不太好,如果它保持不变,市场应该会下跌

pokemon pang :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

104327919 : 好

105241192 : 股市正大涨,不降息。

VERY LUCKY : 我想知道为什么3%如此难以突破,以及为什么美联储将通货膨胀率定为2%。![思考 [思考]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)