Options Market Statistics: Pfizer's Stock Surges as Paxlovid Sales Surprise, Options Pop

News Highlights

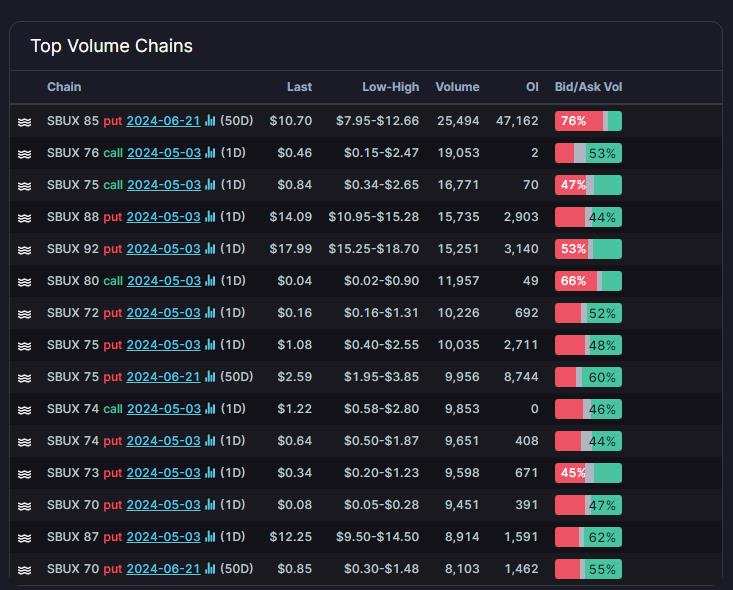

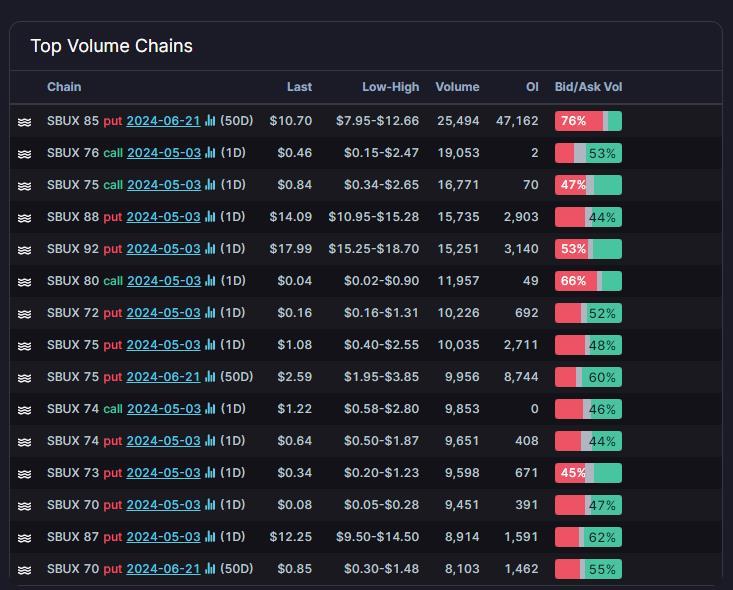

$Starbucks(SBUX.US$ shares fell by 15.88%, closing at $74.44. Its options trading volume was 1.21 million. Call contracts account for 45.2% of the total trading volume. The most traded contracts are $85 puts strike price that expire on May 3rd. The total volume reaches 25,494 with an open interest of 47,162.

Morgan Stanley reported that Starbucks delivered a weaker performance in fiscal Q2 than expected, describing it as a "historically weak quarter." The company's growth forecast for the fiscal year has been downgraded, with Morgan Stanley suggesting improvement might not be seen until the following year. U.S. same-store sales fell by 3%, more than double the anticipated decline, while sales in China dropped by 11%, significantly below expectations. The operational margin was also lower than forecasted at 12.8%, and earnings per share fell short at $0.68 versus the expected $0.80. Starbucks now expects flat to marginally negative same-store sales in the U.S. and worldwide, coupled with a slowdown in global store expansion to about 6%. Consequently, the company's total revenue growth projection has been revised to low single digits.

$Pfizer(PFE.US$ shares surged by 6.90%, with option volume of nearly 0.72 million contracts, and calls accounted for 58% of the volume. The 27.00 calls and puts expiring in a 3rd and 17th were traded most actively, signaling drastic volatility ahead.

The pharmaceutical company reported first-quarter results that exceeded analyst expectations, leading to a 6.09% increase in its stock price to close at $27.18. This marked the largest percentage rise since November 26, 2021. Despite a 20% decline in quarterly sales to $14.9 billion, primarily due to reduced Covid-19 vaccine revenue, sales of non-Covid products grew by 11%. JPMorgan Chase analysts noted the strong revenue was driven by solid Paxlovid sales and other prescription drugs performing as expected. The company also raised its earnings-per-share guidance for the year. Pfizer's CEO, Albert Bourla, expressed his belief that the company's stock is currently undervalued but remains optimistic about future valuation improvements.

Unusual Stock Options Activity

There was a noteworthy activity in $New York Community Bancorp(NYCB.US$ , which is primarily being driven by activity on the June 21 Put. The highest volume over open interest ratio reaches 158.1x with nearly 68,630 contracts, so it's likely that nearly all of the volume represents fresh positioning.

For all the mooers in Singapore, you can now lower your options commssions with our new campaign. Come check the link: US Stock Option.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment