Dividend Reinvestment Plan

1. What is DRIP?

The Dividend Reinvestment Plan (DRIP) is a fully automated reinvestment service offered by Moomoo Financial Inc. By enrolling in the plan, your cash dividends from a specific stock will be automatically reinvested in additional shares of the same stock. If the cash dividends are insufficient to purchase a whole share, a fractional shares* order will be placed instead. This approach helps compound the growth of your account by making more effective use of your cash dividends.

*Note: Enrolling in the DRIP may result in the purchase of fractional shares, with up to four decimal places.

2. How to enroll in a DRIP?

To ensure that your dividends can be reinvested automatically upon arrival, it is suggested that you enroll in a DRIP immediately after purchasing a stock or ETF.

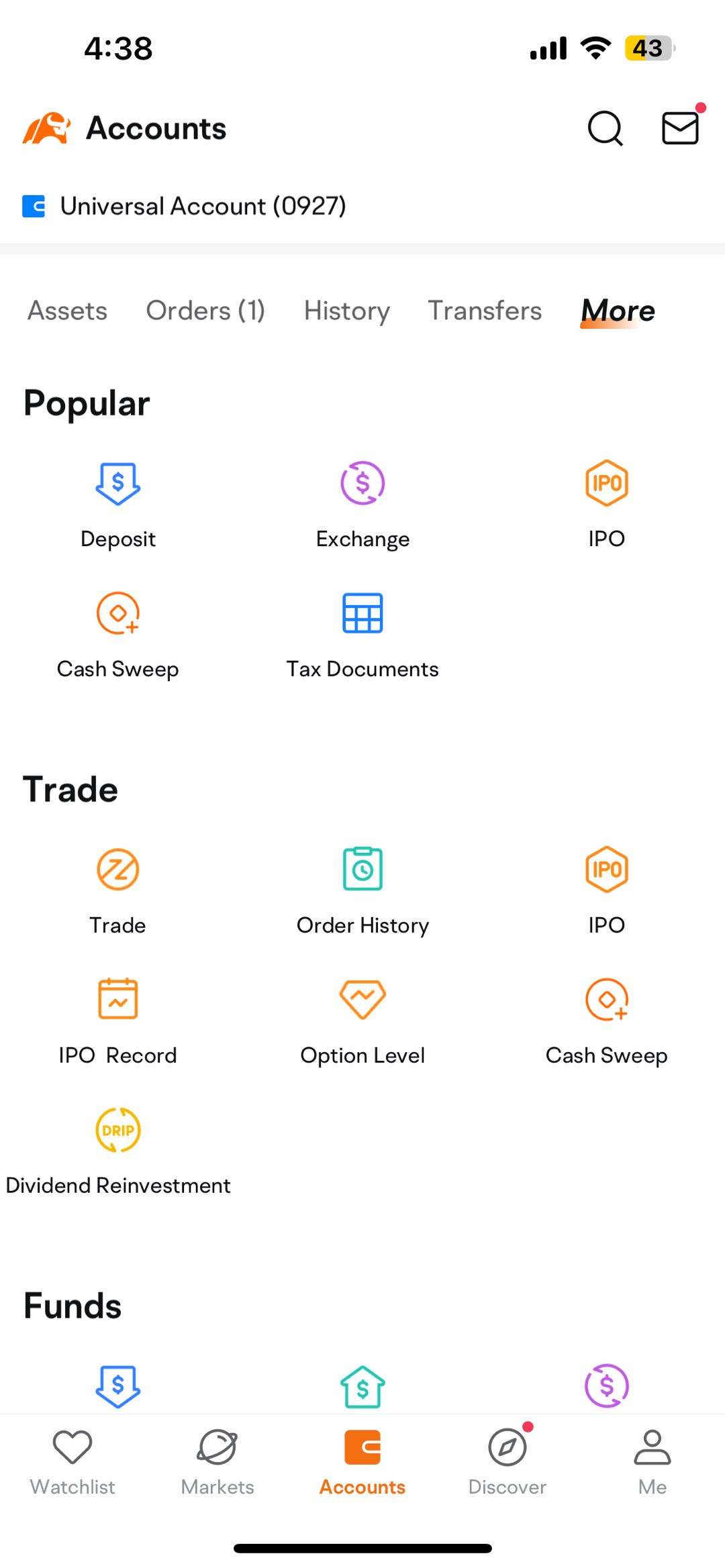

To enroll in the moomoo app, go to:

-

Accounts > More > Trade > Dividend Reinvestment

3. When are dividends reinvested?

If you enroll in DRIP and register as a shareholder before the dividend payout date, your dividends will be automatically reinvested in the same stock using a Market on Close (MOC) order. The cost per share will be based on the weighted average fill price of all MOC orders for the stock on that specific trading day.

Notes:

-

The purchase of shares through your DRIP is usually executed near the market close. Even though the purchase may be filled at different prices, all DRIP investors will ultimately acquire shares of the same stock at the same price, which is the weighted average price of all the MOC orders.

-

An MOC order is submitted to execute as close to the closing price as possible.

4. What are the enrollment requirements?

DRIP is only available for certain US-listed stocks that distribute cash dividends. To enroll, you will also need a Universal Account that supports fractional trading.

Notes:

-

Not all US-listed stocks support DRIP. Stocks and ETFs that support it will have a DRIP icon shown on their quotes page.

-

Products such as bonds and funds are not available for DRIP as they do not support fractional trading.

5. When is the enrollment deadline and the arrival date of shares?

To reinvest your dividends earned through a specific stock or ETF that supports DRIP, pay attention to the following dates:

-

Deadline: Before 00:00 midnight Eastern Time on the day before the dividend payout date.

-

Arrival Date: Usually arrive on the next business day after the dividend payout date.

6. What may cause a dividend reinvestment failure?

A dividend reinvestment failure may be caused by the following:

-

A lack of liquidity in the market

-

Missing the DRIP enrollment deadline

-

Not meeting the margin requirement by making the dividend reinvestment

-

Uncertified tax status or back-up withholding

-

Anti-money laundering mechanism

-

Other cases where limitations apply

Ensure there is sufficient buying power in your account before trying to enroll again. Consider enrolling in several stocks or ETF DRIPs to test if you can enroll successfully. Or, contact our customer support team for assistance in getting enrolled in a stock or ETF of your choice.

7. Will all my cash dividends be reinvested?

If your account is subject to withholding tax, only dividends after taxes will be reinvested.

8. Are dividends from shares purchased on margin eligible?

Dividends from shares purchased on margin are eligible and will be reinvested through your DRIP.

9. Are dividends from shares in the Stock Yield Program eligible?

Dividends from shares lent through the Stock Yield Program are eligible and will be reinvested through your DRIP.

10. Where can I find details about DRIP shares in my account statements?

Details about your DRIP shares are in the Trade History section of your statements. Orders for dividend reinvestment will be marked with "DRIP."

11. Does purchasing shares through a DRIP incur any commissions?

Commissions for DRIP shares will be charged at the rate applicable to fractional shares orders. For more details, click here.

Overview

- 1. What is DRIP?

- 2. How to enroll in a DRIP?

- 3. When are dividends reinvested?

- 4. What are the enrollment requirements?

- 5. When is the enrollment deadline and the arrival date of shares?

- 6. What may cause a dividend reinvestment failure?

- 7. Will all my cash dividends be reinvested?

- 8. Are dividends from shares purchased on margin eligible?

- 9. Are dividends from shares in the Stock Yield Program eligible?

- 10. Where can I find details about DRIP shares in my account statements?

- 11. Does purchasing shares through aDRIP incur any commissions?

- No more -