Trade Index Options

1. FAQs

The trading method of index options is the same as stock options. For operation instructions and related information, you can refer to stock options trading. However, as an independent option type, index options have their own characteristics in trading.

1.1 How to trade index options?

Same as stock options, please refer to stock options trading.

1.2 What is the minimum trading unit for index options?

Same as stock options, please refer to stock options trading.

1.3 What are the trading hours for index options?

-

Regular trading day:

-

9:30~16:15 US Eastern Time

-

Last trading day:

-

AM-settled index options: 9:30~16:15 US Eastern Time

-

PM-settled index options: 9:30~16:00 US Eastern Time

Except for the above trading sessions, Moomoo SG does not support other trading sessions for index options.

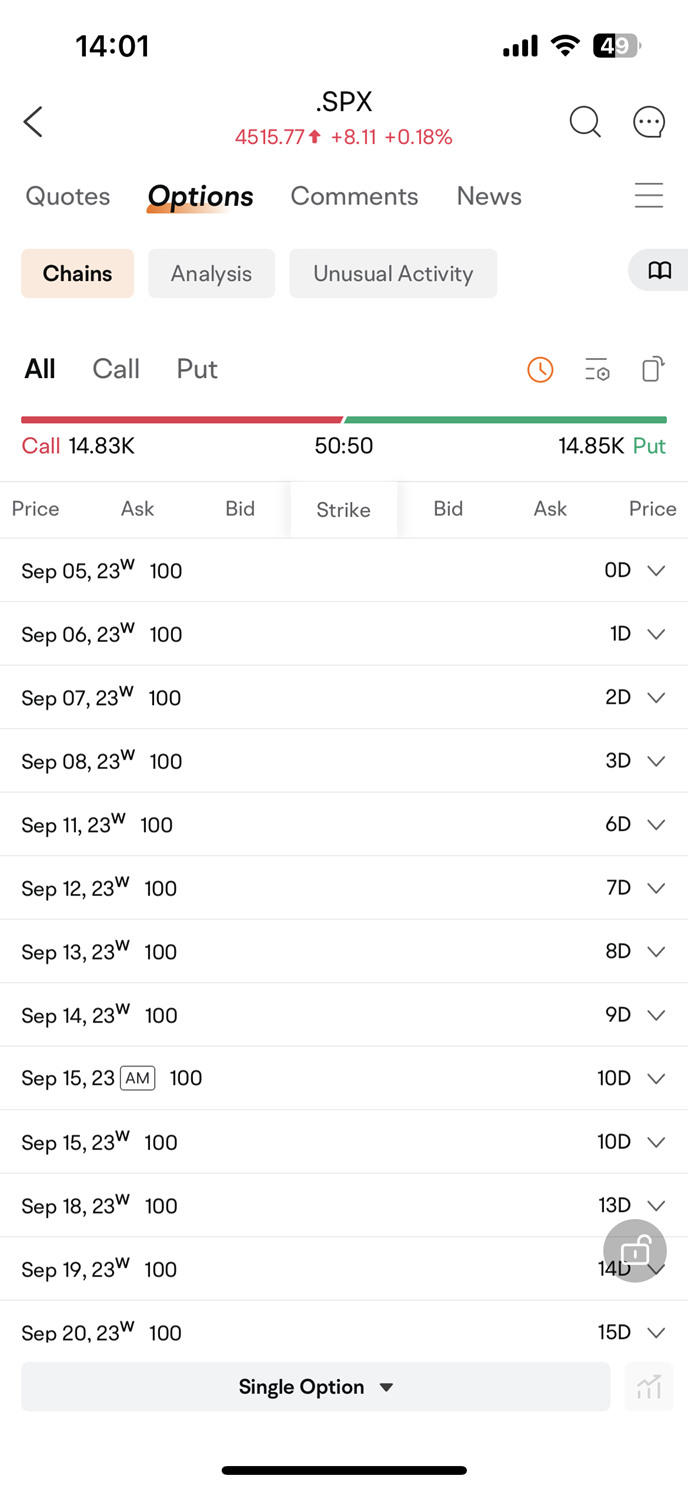

1.4 Why can't I trade some index options on the expiration date?

Index options contracts have an expiration date and last trading day respectively.

-

AM-settled index options: The last trading day is the trading day before the expiration date.

-

PM-settled index options: The last trading day is the expiration date.

Index options can only be traded on or before the last trading day. Therefore, AM-settled index options can't be traded on the expiration date.

SPXW230915C4500000 and SPX230915C4500000 both expire on September 15, 2023. However, the former can be traded on the expiration date and the latter can't.

2. Index Options Order Types

Index options support both single-leg and multi-leg orders.

2.1 Single-Leg Orders

Placing orders for single-leg index options follows the same process for single-leg stock options, with fewer supported order types:

-

Supported order types: market, limit, stop, stop limit, market-if-touched, limit-if-touched, trailing stop, and trailing stop limit.

-

Attached orders are currently not supported.

For more information, refer to the help article "Order Types".

2.2 Multi-Leg Orders

Placing orders for multi-leg index options follows the same process for multi-leg stock options. You can open, close, and roll over option strategies.

However, since the underlying indexes are not tradable, index options support fewer order types for option strategies than US stock options:

-

Vertical Spread

-

Straddle

-

Strangle

-

Butterfly

-

Condor

-

Iron Butterfly

-

Iron Condor

-

Calendar Spread

-

Diagonal Spread

-

Custom Strategy

For more information, refer to the help articles "Multi-Leg Options Orders" and "US stock options rolling"

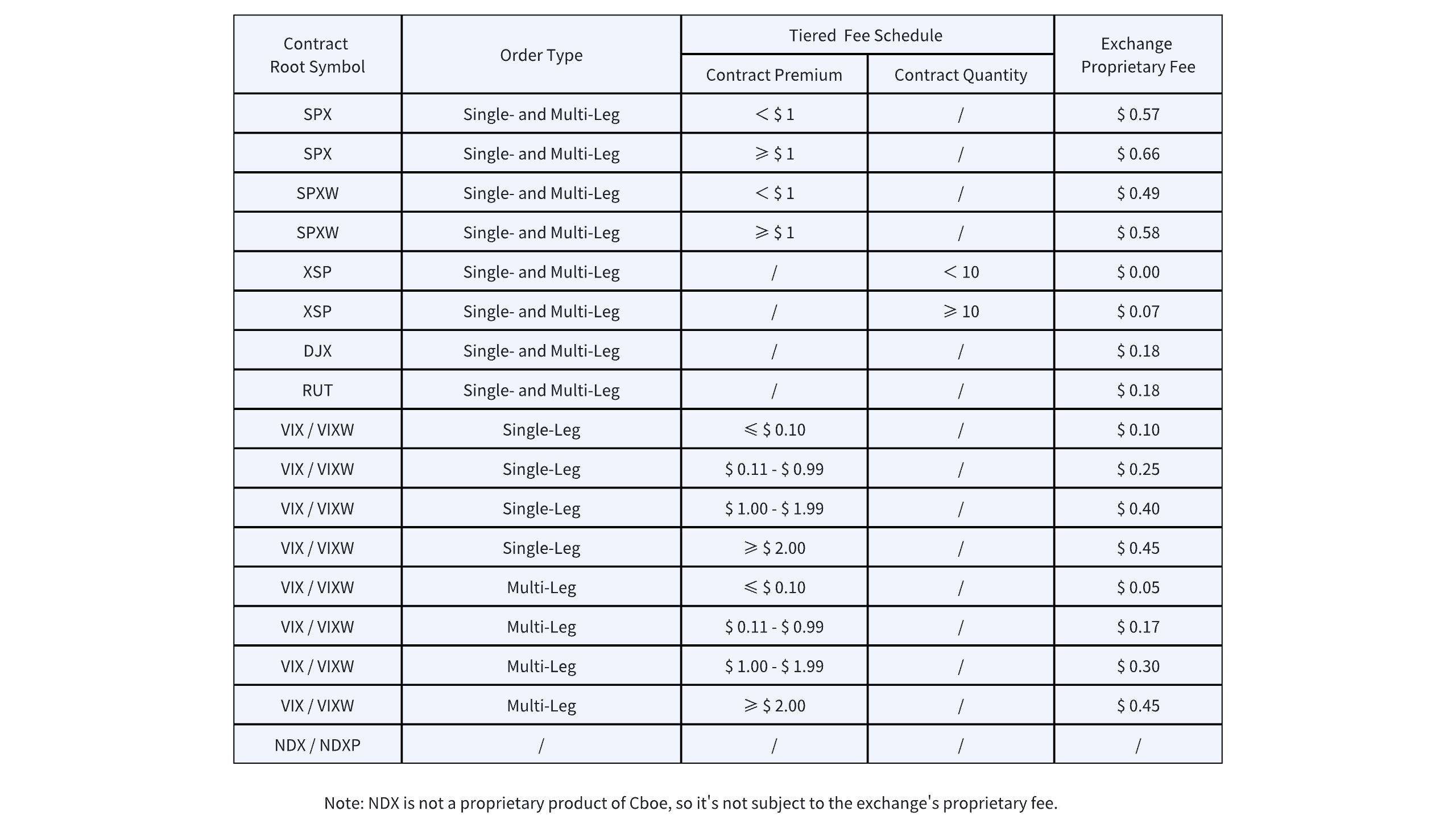

3. Index Options Trading Fees

Index options trading incurs trading fees, a platform fee, and regulatory fees. The fee structure is largely similar to stock options, except that index options trading is subject to an additional exchange proprietary fee.

3.1 Commission and Platform Fee

For more information, refer to the help articles "U.S. stock option fees" and "US Stock Multi-Leg Options Fees".

3.2 Index Options Exchange Proprietary Fee

Many index options are listed exclusively on Cboe and are its proprietary products. Cboe charges the exchange proprietary fee when positions are both opened and closed.

Moomoo SG temporarily waives this fee for customers. The fee schedule will be updated by Moomoo SG in the event of any fee revisions. It is encouraged to refer to our full fee schedule for all chargeable fees.

3.3 Regulatory Fees

Same as stock options. For more information, refer to the help article "U.S. stock option fees" .

Overview

- 1. FAQs

- 1.1 How to trade index options?

- 1.2 What is the minimum trading unit for index options?

- 1.3 What are the trading hours for index options?

- 1.4 Why can't I trade some index options on the expiration date?

- 2. Index Options Order Types

- 2.1 Single-Leg Orders

- 2.2 Multi-Leg Orders

- 3. Index Options Trading Fees

- 3.1 Commission and Platform Fee

- 3.2Index Options Exchange Proprietary Fee

- 3.3 Regulatory Fees

- No more -